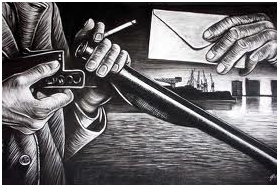

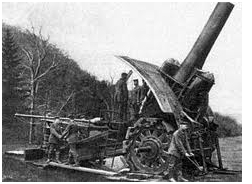

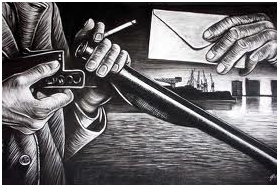

This week about Big Berta, Stiglitz’ duel with bad speculators, why Greece needs planning commissioners and about open hunting season for bad news messengers in the European Parliament.

The second round of three-year tender loans of the European Central Bank (according to ECB President Mario Draghi so-called “Big Bertha”) flooded the system with 529.5 bln of future euro. 800 banks took 3-year loans with interest rates 1% (it was 523 bln. during the first round in December 2011). If we distract from this sum the &sid=1">rolled-over loans (216 bln euro), it gives us 313 bln euro of cash (vs. 213 bln euro in the first round). Within these two LTRO programs ECB released to the system 1 tn euro altogether. These actions should, apart from other results, insure that banks in Europe will not have their hair turned gray because of problems with minimal refinancing until the year 2014, according to Goldman Sachs’ estimations. There will be also less stress on the sovereign bond market. By the way, have you noticed record-high prices at the gas stations?

The second round of three-year tender loans of the European Central Bank (according to ECB President Mario Draghi so-called “Big Bertha”) flooded the system with 529.5 bln of future euro. 800 banks took 3-year loans with interest rates 1% (it was 523 bln. during the first round in December 2011). If we distract from this sum the &sid=1">rolled-over loans (216 bln euro), it gives us 313 bln euro of cash (vs. 213 bln euro in the first round). Within these two LTRO programs ECB released to the system 1 tn euro altogether. These actions should, apart from other results, insure that banks in Europe will not have their hair turned gray because of problems with minimal refinancing until the year 2014, according to Goldman Sachs’ estimations. There will be also less stress on the sovereign bond market. By the way, have you noticed record-high prices at the gas stations?

ECB hasn’t bought any sovereign bonds for two weeks now. This causes “concerns” that the central bank is not going to follow this controversial policy anymore. Such interpretation seems to be too optimistic for us – we rather perceive it as a break, during which ECB delegated the role of bond purchaser to the commercial banks through LTRO programs. Once the situation deteriorates again, bond purchases will start again – and a rumor is that ECB bought bonds already on the Wednesday right after Big Bertha, this time Portugal ones. We will see what the official numbers will show.

American professor of economics Joseph Stiglitz considers austerity in Europe to be too strict and calls for more solidarity with Greece, for example via larger volume of investments from the European Investment Bank. Here you can see  what the professor said about Greece serving as an advisor to the Greek government in 2010: “If Europe stands for this country, Greece will not have any problems paying off its debts!”. “Greece bankrupt? Absurd!”. It turned into an interesting discussion with a man who, contrary to Stiglitz, has to put money where his mouth is (hedge fund manager Hugh Hendry).

what the professor said about Greece serving as an advisor to the Greek government in 2010: “If Europe stands for this country, Greece will not have any problems paying off its debts!”. “Greece bankrupt? Absurd!”. It turned into an interesting discussion with a man who, contrary to Stiglitz, has to put money where his mouth is (hedge fund manager Hugh Hendry).

The former Greek “Entrepreneur of the year” had his Swiss bank accounts blocked because of suspicion of a tax fraud.

Member of the German government, Minister of Interior Hans Peter Friedrich, openly called for Greece to leave the eurozone for the first time. Obviously, he is not alone in Germany. According to Bild, 62% of Germans are against adopting the second aid package for Greece. German Bundestag, thanks to the votes of opposition, approved it on Monday anyway. It seems that German Chancellor doesn’t mind voices of opposition in such an important issue –unlike the Slovak Prime Minister. As a result, Merkel will continue to lead the government, Radičová not.

Chairman of Euro Group Jean-Claude Juncker doesn’t rule out even the potential third aid package for Greece. Reportedly, the EU would appoint a “commissioner for reconstruction” in Greece, who would supervise and plan the “reconstruction of Greek economy”. Preferably in five-year plans like in the USSR?

According to Open Europe, 85% of Greek debt will be owned by European taxpayers in 2015.

One of the reasons why Draghi intended to avoid classical bankruptcy (here Draghi talks about it in an extensive interview for Frankfurter Allgemeine Zeitung) was effort not to allow further downgrading of the Greek bonds’ rating, so ECB could accept it as a collateral for loans to banks. This aim was not fully realized. Rating agency Standard & Poor’s (S&P) downgraded the Greek rating to the level of partial insolvency. ECB had to cease accepting those bonds as collateral refinancing.

Stay calm, no panic! National central banks (Eurosystem) can have their own (more lenient) rules for collateral. It means that haunted Greek banks can be helped out by the Greek central bank (for example through the Emergency Liquidity Assistance program – ELA). Different requirements for collateral across national central bank s will cause an interesting situation, which violates the rule of equal share of losses within the Eurosystem, and may lead to a situation when each central bank has different credit risk. Jens Weidmann, German Central Bank Governor wrote a letter to Draghi after the second Big Bertha, in which he expressed his concern about the increasing risk resulting from loosening rules applying to collateral in the Eurosystem (for which he voted himself…).

s will cause an interesting situation, which violates the rule of equal share of losses within the Eurosystem, and may lead to a situation when each central bank has different credit risk. Jens Weidmann, German Central Bank Governor wrote a letter to Draghi after the second Big Bertha, in which he expressed his concern about the increasing risk resulting from loosening rules applying to collateral in the Eurosystem (for which he voted himself…).

Spanish state finished in 2010 with a deficit 8.51% of GDP. Plan for this country, established by the European Commission, was 6%. Will there be any punishment?

G20 doesn’t want to raise funds for IMF, until European countries won’t rise more money for “protecting” Europe themselves. Especially Germany is against increasing ESM from 500 to 750 bln euro, which was proclaimed last year. However, Merkel already underlined that Germany may surrender to increasing ESM in March. For Obama, such apparent rescue of Europeans via IMF might backfire at home during the election year.

There is a proposal in the European Parliament, which will serve as a base for reaching an agreement on a new legislation, which would temporarily ban downgrading rating for the problematic European countries in bad times, and call for setting up a “fully independent public European Credit Rating Agency”. Kind of “what is not seen, does not exist” or “shoot the messengers of bad news and everything will be fine” attitude. The European Parliament should rather think about why the public regulator of the financial market helped to create a cartel of rating agencies by accepting rating of only three selected companies.

Politicians in Brussels signed so-called Fiscal Compact Treaty. It seems that apart from France, where presidential elections will be held and popular socialist candidate talks about necessity to negotiate an agreement, there will be a problem with the ratification of the fiscal pact also in Ireland. Irish Prime Minister Enda Kenny will probably announce referendum concerning fiscal pact in May. He will do so on the recommendation of the Attorney General, who described agreement as “a unique instrument outside the EU treaty architecture”. Deputy Prime Minister of Ireland Eamon Gilmore clearly described the “right” choice for Irish citizens, if they still wish to receive aid from the EU. Referendum is an unnecessary worry. After all, Ireland has already proved, that when needed they can repeat referendum until the right “European” answer is given.

German professor Philipp Bagus, author of “The Tragedy of the Euro”, considered possible scenarios for the development in the eurozone in his new article. If the French interests win, losses from bad investment decisions caused by euro will be paid by taxpayers from the core countries of EMU and via higher inflation by all those who use euro. If German interests win, these losses will be paid mainly by taxpayers from the peripheral countries through higher taxes and forced privatization, and by private creditors of Greece by participating on losses resulting from debt restructuring. You miss scenario in which Slovak interests win? Hilarious joke.

Have a joyful weekend!

Juraj Karpiš