On May 11, Lithuania celebrated its second National Respect for Taxpayers Day. This day became an official commemorative day in Lithuania following the adoption of a proposal from the Lithuanian Free Market Institute (LFMI) in early 2018.

On this occasion last year, LFMI launched The Charter of Taxpayer’s Rights to highlight that taxpayers have not only duties to fulfill, but also rights to enjoy.

This year we have looked into how some of those rights (the right to tax stability and the right to the quality of tax legislation) are secured.

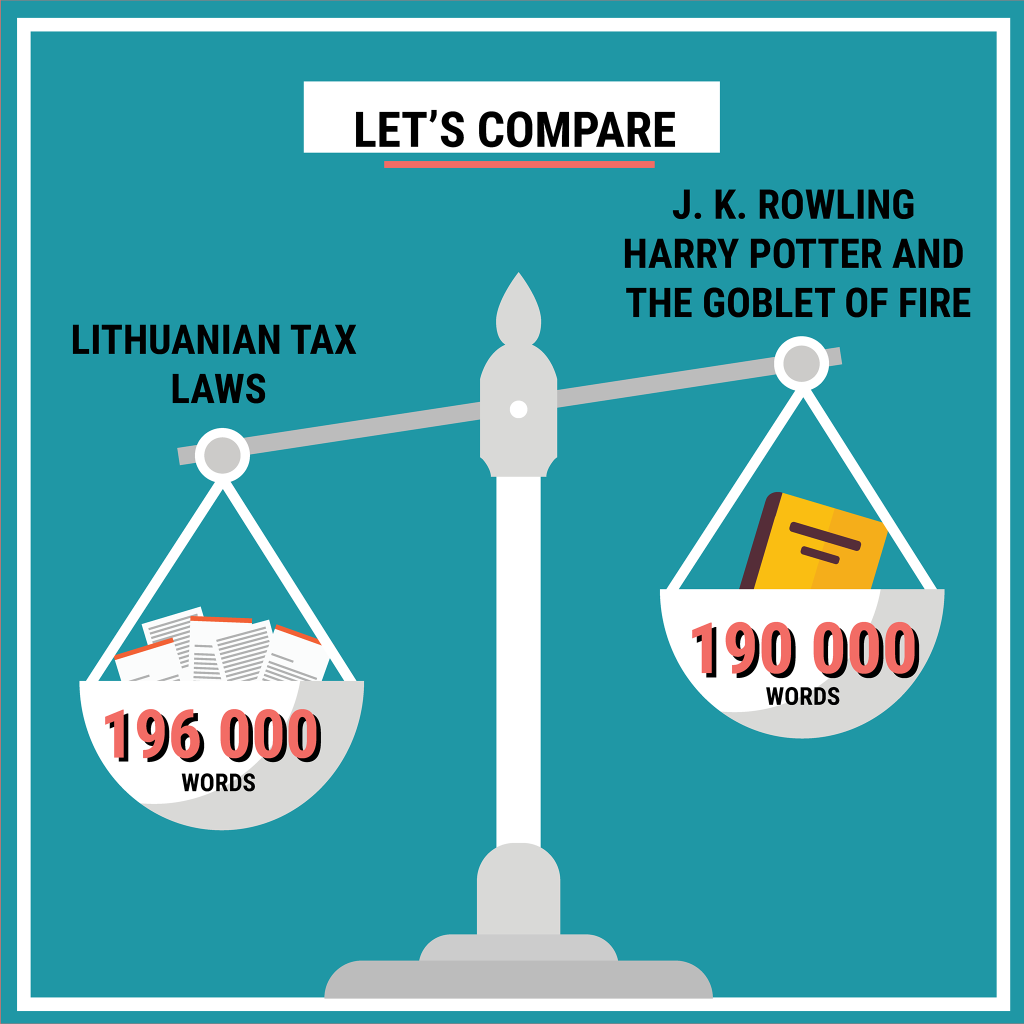

Taxes, their size and ambiguity, instability, and administrative complexity are constantly highlighted as some of the most pressing problems for Lithuanian taxpayers and businesses.

If we want to have taxes that are simple and easy to calculate, declare, pay, and administer, the regulatory environment must be consistent, logical, accurate and clear. Only then can taxpayers avoid confusion in understanding tax laws, their interpretations, and declaration.

To achieve that, proper impact assessment and public consultations are needed prior to adopting any new laws.

Status Quo

The Lithuanian Free Market Institute has analyzed nearly 400 original legislative initiatives regarding the main tax laws in the period of 2015 through 2019.

The analysis shows that a total of 391 original draft amendments were proposed during that period, of which 121 were passed. The total number of documents, including different versions of legislative initiatives and adopted bills, reached 806.

A proper public engagement in a legislative process like this does not look odds-on, to say the least. The research shows that ex-ante impact assessment is not thorough during the legislative drafting process.

On a 11-point scale measuring the presence of explanatory notes and in detail, the average score for original draft legislation is 3.1 and for adopted legislation, 4.1.

As many as 60% of original proposed amendments to tax laws were not subjected to impact assessment on business conditions.

A total of 75% of original legislative initiatives were not subjected to impact assessment regarding possible negative consequences, while 77%, to impact assessment regarding corruption. Many statements provided in the explanatory notes are a sheer formality, they are not supported with any data, evidence, or analysis.

The analysis finds that 49% of original draft laws were not evaluated in terms of their impact on state finances. This raises questions whether taxpayers’ money is spent in an efficient and responsible manner.

85% of the explanatory notes that accompany legislative initiatives do not provide any conclusions from of external experts. This confirms that public involvement in the law-making process is negligible.

The final draft laws voted during the final reading are not necessarily accompanied with explanatory notes and impact assessment that refer to the final wording of the draft legislation. In many cases, explanatory notes pertain to the earlier versions of proposals.

By law, at least a six-month notice period is required for the enforcement of a new legislation. However, there is also an exemption in place that allows for tax laws to be adopted together with a new state budget. Due to this exemption, the average timespan from the adoption of a new tax law until enforcement is 91 days.

Better quality of tax laws would most likely mean fewer changes and more time for public engagement in the legislative process as well as for adjustment to regulatory changes. Better quality of the law-making process would also mean lower costs for taxpayers.

Recommendations

The quality of tax legislation and impact assessment, including its focus, scope, and methods, should be significantly improved.

During the adoption process, the final draft laws should be supported with explanatory notes and impact assessment that refer to the final wording of the draft legislation.

It is necessary to involve the public and NGOs as partners in the legislative process. One way to strengthen feedback from these stakeholder groups is to create a user-friendly infrastructure, to announce and adhere to clear-cut deadlines for harmonizing all draft legislation with the public. Semi-open questionnaires can be one tool to gather stakeholder feedback on the most important provisions.

Authors of legislative proposals should identify the main stakeholders and invite them to take an active part in the lawmaking process. If there is no consensus with the stakeholders, detailed argumentation should be provided. This would at least minimize changes at the later stages of consideration and adoption.

It is advisable to consider abolishing the exception allowing the adoption of amendments to tax laws together with the approval of a new state budget as this often brings considerable financial uncertainty and administrative burdens for taxpayers as well as for the tax administration.

Finally, regulatory fitness assessment should be conducted before proposing any new tax initiatives.