In 2024, Ukraine demonstrated a strong commitment to its economic obligations, meeting key conditions under the IMF and EU support programs. The country remained on track with its structural benchmarks, ensuring the flow of critical financing for non-defense expenditures. Entering 2025, risks persist, but Ukraine’s focus on reforms and its urgent financing needs make staying the course essential.

The IMF’s Extended Fund Facility (EFF) program continues to anchor macroeconomic stability, with the sixth review approved in December 2024, unlocking a USD 1.1 bn tranche. This brought total disbursements from the IMF to USD 9.8bn (63% of USD 15.5bn envisaged under the entire 4-year Extended Fund Facility Program). Besides, during 2024 Ukraine fulfilled all required indicators under the Ukraine Plan, which is necessary to receive financing from the EU under the Ukraine Facility.

However, these were far from all the reforms and measured approved by Ukraine. Some reforms were also conducted to receive financing from the World Bank. Moreover, there is a long European integration agenda for Ukraine, which will require enormous efforts from the Government and the Parliament on the path of Ukraine towards the EU.

Maintaining Reform Momentum in 2025

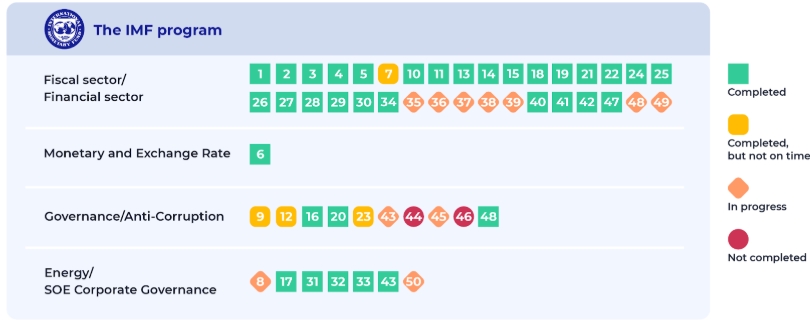

The IMF’s EFF program offers an additional USD 2.7bn in 2025, contingent on four program reviews. Ukraine is still to conduct numerous structural benchmarks (see Figure 1). The new benchmarks are added will all reviews and, thus, it’s not final yet. They cover a broad scope of spheres, mostly in fiscal policy. In particular, during 6th review of the program three new benchmarks were added: three new structural benchmarks – two in the financial sector (enhancing securities market regulation and mitigating operational risks in financial institutions) and one in the energy sector (independent assessment of the NEURC).

The next program review, scheduled for March 2025, will assess progress on the implementation of benchmarks with the deadline of implementation by the end of December, which could enable another tranche of assistance at USD 900 m. As of January 2025, Ukraine had successfully met six of eight key structural benchmarks with such deadline:

- Aligning medium-term budget planning with capital expenditure

- Strengthening NEURC’s independence

- Establishing a framework for bank recovery

- Implementing a risk assessment methodology for the NBU

- Forming a Supervisory Board for Ukrenergo

- Adopting reform of the Accounting Chamber

However, unresolved issues in judicial reform—including the abolition of the Lozovyi amendments and the creation of a new administrative court—could delay future IMF disbursements or require the IMF to agree to postpone the deadlines. Successfully meeting IMF conditions in 2025 is essential, as this program plays a crucial role in unlocking broader international financing beyond 2026.

Figure 1: Map of the implementation of structural benchmarks of the IMF Program

Ukraine Facility: EU Support in 2025

Ukraine remains on track with EU commitments, with continued financing under the Ukraine Facility. In December 2024, the European Commission disbursed EUR 4.1 bn for the completion of nine indicators for Q3 2024. Overall, the EU provided to Ukraine EUR 16.1 bn in 2024 out of EUR 50 bn envisaged for 2024-2027. Overall, the Ukraine Facility contains three pillars of support:

- Pillar I – financial support in the form of grants and loans to the State: consists of EUR 33 bn in loans and EUR 5.27 bn in grants, directly financing government expenditures;

- Pillar II – a specific Ukraine Investment Framework – allocates EUR 7 bn for investments;

- Pillar III – technical assistance and other supporting measures – provides EUR 4.76 billion to cover interest payments on Ukraine’s EU loans, along with funding for technical cooperation and administrative support.

As all Q4 2024 indicators were met, EUR 3.5bn is expected in February 2025.

Figure 2: Map of the implementation of the indicators of the Ukraine Plan

By March 2025, Ukraine aims to fulfill 16 indicators for Q1 2025, ensuring additional disbursements. The European Commission’s Scoreboard dashboard, set to launch in early 2025, will provide biannual updates on Ukraine’s progress, reinforcing transparency in the reform process.

G7 Support under ERA Mechanism

Ukraine’s budgetary position in 2025 is more stable than in previous years, largely due to the USD 50bn loan from the G7, structured under the Extraordinary Revenue Acceleration (ERA) Loans for Ukraine. This funding, to be repaid from profits on frozen Russian assets, significantly reduces immediate fiscal pressures. On December 3, 2024, Ukraine’s Verkhovna Rada passed legislation introducing “contingent debt obligations” into the Budget Code, ensuring that ERA financing does not increase public debt.

The US transferred its contribution to ERA of USD 20 bn to the World Bank account in December 2024: it will be gradually provided to Ukraine over 2025 to finance public sector wages and social support programs (USD 1 bn was already transferred to Ukraine in December 2024). The EU has also disbursed EUR 3 bn of its contribution to ERA in January 2025, with further tranches expected throughout 2025.

Japan and the UK also contribute to ERA. In particular, the UK provides military financing. The EU contribution can also be spent for both military and civilian budgets. Therefore, if military support by the US and other countries is spent for military procurements, then the Government may be scarce on financing civilian expenditures. Currently, defense and security expenditures account for more than 50% of Ukraine’s central government budget.

Sustaining Economic Resilience Beyond 2025

While Ukraine enters 2025 with a stronger financial position, challenges remain. The ERA loan, IMF program, and Ukraine Facility funds provide a critical lifeline, but continued reform implementation is non-negotiable. Ukraine needs to stay on track with reforms to sustain economic development and secure financing for non-defense expenditures. If ERA funds are increasingly allocated to military spending, funding for other vital government functions could become constrained.

Despite improved fiscal stability, Ukrainian government must use ERA funds wisely, ensuring a financial reserve for 2026-2027. Looking beyond 2025, IMF participation is essential for unlocking further international assistance. Ukraine’s ability to meet reform benchmarks will determine its ability to access additional financing in 2026 and beyond. One of the key sources of financing for assistance to Ukraine should be the full confiscation of frozen Russian assets, currently held in the EU, US, and other allied nations. Redirecting these assets to support Ukraine’s reconstruction and economic recovery is the most viable strategy for ensuring sustainable development and long-term resilience.

This article is based on the monitoring, conducted by consortium RRR4U (Resilience, Reconstruction and Relief for Ukraine), which is comprised of four of Ukraine’s CSOs – DiXi Group, Institute for Economic Research and Policy Consulting, Center for Economic Strategy, Institute for Analysis and Advocacy. The activities of RRR4U are supported by the International Renaissance Foundation.