2025 became another year of war, resilience, and adaptation for Ukraine. Russia’s full-scale war against Ukraine continued and resulted in territorial losses, destruction of energy facilities, and other critical infrastructure, including railways and seaports. Therefore, according to IER estimates, real GDP grew by approximately 2%.

Financial support from international partners was stable thanks to the ERA mechanism adopted in 2024, funded by interest on immobilized Russian assets, and the continuation of financing under the Ukraine Facility. However, the situation with military support was less clear given the limited assistance from the United States, which, after President Trump’s inauguration, pursued a policy of “reduced aid to force peace” throughout the year.

Despite several rounds of negotiations between Ukraine and the United States, and between the United States and Russia, peace was not achieved, which was reasonably expected given the aggressor state’s previous behavior. Instead, throughout the year, the defense industry in Ukraine grew, along with commercial imports of defense equipment and components. Ukrainian defense industry companies took their first steps toward operating in EU markets.

The change in U.S. approaches to supporting Ukraine forced the EU to adapt its policy and assume a leading role in supporting Ukraine. Challenges, risks, and uncertainty will also characterize 2026. Financing from the EU for this year was expected to be provided through the Reparation Loan, but instead, the EU will raise appropriate funding on the capital markets.

For Ukraine to withstand, it needs to receive financial and military aid on time. This aid is also crucial for any peace agreements, which require precise and strong security guarantees.

Ukraine and the EU: Transition to the Next Stage of Integration

In September 2025, Ukraine completed all screenings for all negotiating chapters. A reform roadmap for Cluster 1 was also adopted. However, due to Hungary’s blocking, the EU has not adopted a decision to open negotiating clusters. This situation was further complicated during the summer by parliament’s decision to limit the independence of NABU and SAPU, which was later reversed after the “cardboard revolution.”

After lengthy negotiations and the search for alternative solutions, an informal meeting of ministers of EU member states for European affairs with the Ukrainian side took place on December 11. This meeting effectively formalized the “front-loading” initiative (agreeing on reforms and negotiating positions before the official opening of negotiations) developed by the European Commission. Thus, although clusters are officially still not open, accession negotiations are already taking place for three clusters.

For these, the EU transmitted to Ukraine negotiating positions approved by the other EU countries, as well as the indicators (benchmarks) that must be met to close the clusters. There is an agreement that accession negotiations on the remaining three clusters will begin in early 2026. In this way, Hungary’s veto on the negotiation process has effectively been bypassed, although its approval remains necessary for further progress, including the formal opening and closing of clusters. Nevertheless, the opening and closing of clusters can happen simultaneously if actual negotiations are completed before Hungary changes its position.

For national coordination of reforms on the path to European integration, the government developed a draft National Program for Legal Approximation, which is to be adopted in early 2026. This is an ambitious program that envisages the adoption of numerous legislative and regulatory acts. Therefore, it is essential that the government and parliament work clearly and thoroughly, and that they make important decisions on time. The National Program envisages that all measures will be implemented in 2026-2027, which is a highly ambitious plan.

International Support: Fulfillment of Commitments Deteriorated

Ukraine’s fulfillment of commitments to international partners deteriorated in 2025. While in 2024 Ukraine timely fulfilled the Ukraine Plan, which serves as the basis for EU assistance under the Ukraine Facility, the situation in 2025 was completely different.

Firstly, this can be explained by the fact that individual indicators are more complex than in 2024. However, unfortunately, it should be noted that the political will to timely and fully fulfill quarterly commitments somewhat decreased after the European Commission adopted a mechanism for providing partial tranches; thus, in 2025, Ukraine did not receive the planned financing under the Ukraine Facility for indicators that were not fulfilled, or received it with a delay after fulfillment. At the end of 2025, Ukraine had not fulfilled indicators worth EUR 3.6 billion out of the planned EUR 11.7 billion.

For each indicator, Ukraine is given an additional 12 months (after the deadline) to fulfill it, after which the funds are permanently lost. Therefore, it is crucial to accelerate work on fulfilling the Ukraine Plan in January, especially given that many decisions involve laws entering into force and the urgent need for financing at the beginning of 2026.

There were also difficulties in implementing the IMF Program throughout the year. Due to the IMF’s flexible approach during the full-scale war, some structural benchmarks were postponed because Ukraine did not fulfill them on time. However, in May, Ukraine passed the eighth review of the Program, a decision that the IMF Executive Board adopted in June.

As of the end of December, five indicators with a final deadline in December 2025 had not been fulfilled. At the same time, in November, the IMF and Ukraine reached staff-level agreements on a new four-year program worth USD 8.1 billion (equivalent). This program should serve as an anchor for receiving international aid. It contains complex prior actions that were not completed by the end of 2025. This concerns the submission of a bill to abolish the VAT exemption for payers under the simplified taxation system, and the adoption of a law on the taxation of digital platforms and parcels (from zero hryvnias). Therefore, there is a risk that the Program will not start in January 2026, although it is vital for receiving assistance from other partners.

Overall, in 2025, Ukraine received international financial support totaling USD 52.4 billion, of which USD 37.9 billion was under the ERA support instrument from the G7. The EU already directed its full contribution to ERA – USD 20 billion (in equivalent). Therefore, at the beginning of 2026, there remains the outstanding contribution from the US and other partners, which, if received by Ukraine on time, should help get through the first quarter of 2026.

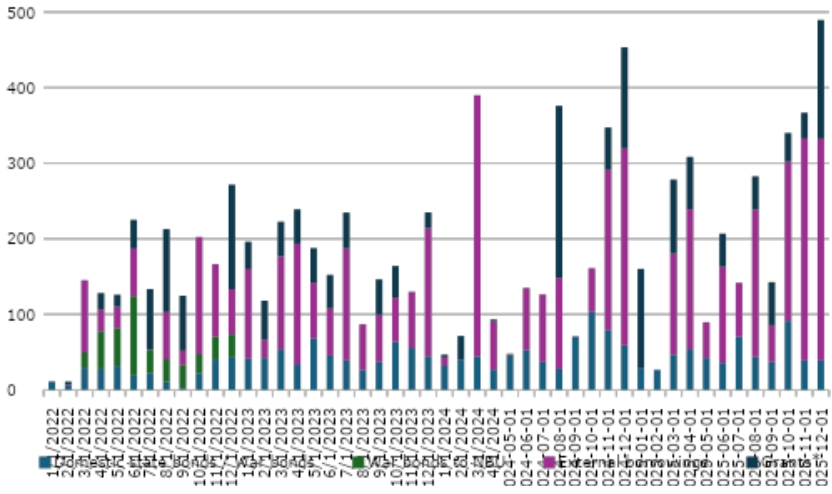

Figure: Financing and grants received by the state budget, UAH bn

Note: * grants are part of budget revenues. External assistance from ERA is included in grants if received from the US through the World Bank account, and in loans if received from other partners.

In 2025, Ukraine received USD 12.1 billion (equivalent) from the EU under the Ukraine Facility (of which USD 668 m in grants), more than a third of which was for meeting fourth-quarter 2024 indicators. Funds also came from the IMF (USD 912 m) and the World Bank (USD 733 m). Japan provided USD 453 m outside of ERA, and USD 232 m came from the EBRD.

Although ERA is Ukraine’s contingent liability as according to the plan it will not have to repay at its own expense, a large portion of the ERA contributions m was structured as loans and is counted as part of the state debt. Also, the remaining financing, with certain exceptions, came in the form of loans. Therefore, state and state-guaranteed debt approached 100% of GDP in 2025. Ukraine also received significant military aid in 2025: the EU’s role in this strengthened due to substantial limitations on such assistance from the US.

International financing for 2026 remains essential, with the need exceeding USD 50 billion. For most of the year, the Reparation Loan from the EU, effectively funded by immobilized Russian assets, was discussed as the primary probable source of financing. However, due to Belgium’s position, which opposed such a support instrument, the EU in December adopted a political decision to borrow up to EUR 90 bn in 2026-2027 on capital markets to assist Ukraine: this concerns military and financial aid. Since the draft of the official decision has not yet been approved, the conditions and regularity of assistance, its format, distribution between military and budget support, and the commitments that Ukraine must fulfill remain unknown.

As far as is known, on December 20, 24 EU countries officially took the first step to provide Ukraine with credit under an enhanced cooperation mechanism, which will allow Ukraine to receive credit without the participation of the Czech Republic, Hungary, and Slovakia. Also, according to the plan, although the aid will be structured as a credit to Ukraine, it will be repaid only at the expense of Russian reparations or immobilized Russian assets. However, Ukraine will need to make considerable efforts to fulfill all commitments to receive aid as planned, rather than with delays.

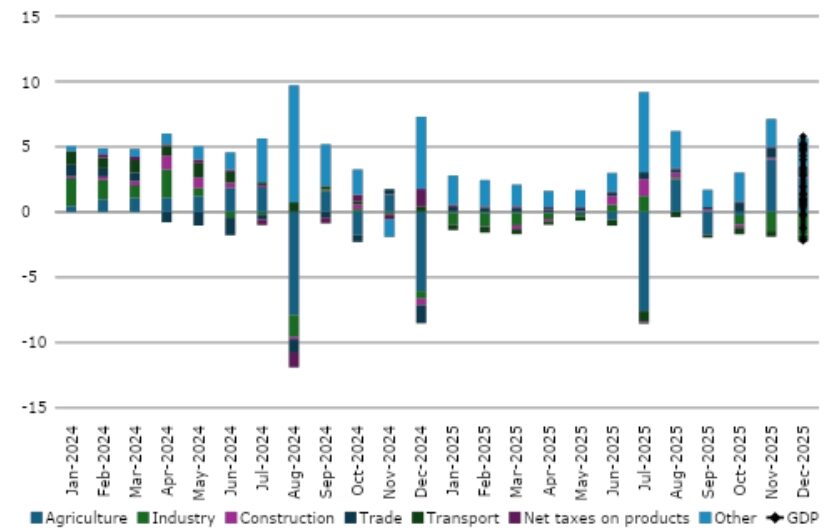

GDP: Moderate Growth Due to Destruction and High Uncertainty

In 2025, Ukraine’s economy grew moderately. According to IER estimates, real GDP grew by 1.8% although the estimate may be revised. At the end of the year, many organizations and institutions revised their economic growth estimates downward due to significant Russian destruction of gas extraction facilities, energy networks, ports, and railway infrastructure.

In November 2025, for the first time since December 2024, limited access to electricity returned to the top three obstacles to company operations (according to IER surveys). The other two obstacles throughout the year were labor shortages and danger to work.

Thus, businesses increasingly face the problem of finding labor, and in autumn faced an outflow of men aged 18-22 who were allowed to leave Ukraine. At the same time, unemployment, according to the Ministry of Economy’s estimates, remains high, with a significant skills gap and regional imbalances in labor supply and demand. A substantial obstacle to company operations was also the increase in the prices of raw and other materials. Partly, this is likely related to the hryvnia’s devaluation against the euro. Businesses also faced decreased demand and logistics problems.

Nevertheless, the grain harvest in 2025 was better than initially expected. This reduced the negative impact of agricultural decline on economic growth. Demand for defense industry products contributed to the development of machine building. High domestic demand for metallurgical products contributed to the sector’s growth. Growth in the trade sector was explained by higher real household income from higher wages and pension indexation, and by restrained price growth for non-food goods.

On the demand side, real final household consumption and investments grew, leading to higher imports. At the same time, real exports decreased significantly due to lower volumes of grain and oilseed exports, reflecting the absence of previous years’ stocks. Government consumption grew thanks to defence procurement.

Although we expected that in 2025 there would be a greater contribution from the investment part of the Ukraine Facility, military risk insurance, and guarantees, this did not happen. Therefore, we retain these hopes for 2026. It is unlikely that peace will be achieved quickly this year, and hence, challenges and uncertainty will accompany us throughout the year.

Overall, we expect real GDP growth in 2026 to be only slightly above 2%.

Figure: Contributions to real GDP, p.p.

Energy: New Philosophy of Resilience

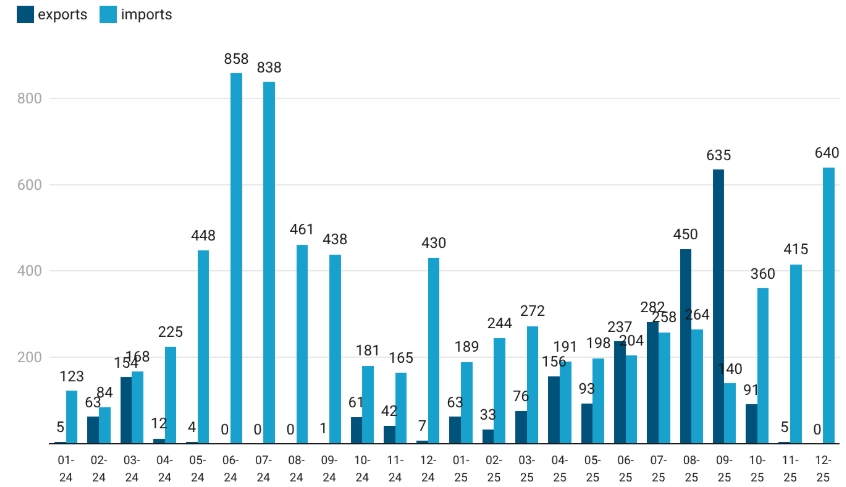

The electricity sector in 2025 went through a transformation of the entire system’s logic, focusing on decentralization and building a new philosophy of resilience. Throughout the year, energy infrastructure suffered over 4,500 attacks, resulting in a total loss of about 11 GW of generation since the beginning of the full-scale invasion. Despite this, the sector demonstrated development: over the year, more than 1.5 GW of renewable generation was launched (1 GW solar and 500 MW gas), and energy storage systems made a tremendous leap, reaching over 500 MW of installed capacity, which is half of the need calculated by Ukrenergo. Electricity exports in September reached a record 635 thousand MWh, but by November, they were stopped entirely due to massive Russian strikes.

In the legislative and regulatory field, key events included the transition to the European 230 V voltage standard, the introduction of regional energy independence passports, and the launch of the digital Registry of Renewable Energy Objects. At the same time, the sector was struck by a systemic debt crisis: mutual debt between market participants exceeded UAH 40 bn. To mitigate it, parliament directed UAH 10 bn of Ukrenergo’s funds to repay debts to the balancing market and renewable energy producers. In addition, Ukrenergo restructured “green” bonds worth USD 825 m until 2031. The year ended with profound personnel changes and the suspension of the leadership of the Ministry of Energy following the exposure of large-scale corruption at Energoatom.

Figure. Exports and imports of electricity in 2024-2025, thous. MWh

Note: Figures based on data on commercial electricity flows to/from Ukraine. Customs data may differ from these figures

In 2025, the gas sector began a new era, completely abandoning Russian gas transit for the first time, starting January 1. This led to a change in the logic of the GTS operation and strengthened cooperation with European operators, particularly through the Trans-Balkan corridor and LNG imports from the US through terminals in Greece and Poland. Domestic production decreased by approximately 6-7% (to 16.9 bcm) due to Russian destruction of extraction facilities, which in October temporarily put up to 60% of extraction capacity out of service. The total volume of imports (commercial flows to Ukraine, including gas in customs warehouse regime) amounted to 6.3 bcm, most of which was provided by Naftogaz at the expense of international financial assistance.

In February 2025, a historic event occurred, namely, the first export supply of Ukrainian biomethane to the EU. Five biomethane plants are already operating in Ukraine. A significant achievement was the June arbitration victory against Gazprom, which was ordered to pay USD 1.37 bn, although the prospects of payment remain uncertain. The financial condition of the sector remained difficult due to the PSO mechanism, which created a “financial hole” in Naftogaz: the company bought gas at market prices and sold it at low administrative tariffs. In addition, in the fourth quarter of 2025, the company was forced to raise additional financing to import gas to offset lost domestic gas production.

The oil sector focused on ensuring the domestic market and on attracting investment in extraction, despite the systematic destruction of refining infrastructure. Throughout the year, the enemy destroyed the oil refinery in Merefa and attacked the SOCAR oil depot in the Odesa region. From May 1, legislation required adding at least 5% bioethanol to A-92 and A-95 gasoline grades. In the extraction sphere, Ukrnafta began geological exploration at the large Oleska area, where extraction of both traditional and non-traditional deposits (shale gas and tight oil) is expected. In addition, the government announced new tenders for developing oil and gas sites under production-sharing agreements with a resource base of 55 m t of hydrocarbons, which provide partners from the US with priority rights to purchase products.

The coal industry in 2025 found itself in critical conditions due to the frontline approaching key extraction centers. The number of working mines in Ukraine decreased to 14 (down from 145 in 2014), and the planned annual extraction amounted to about 15 m t. Although in early autumn, thermal power plant warehouses accumulated a record 2-3 m t of coal, strikes at enrichment plants, such as Almazna, paralyzed the processing of raw materials. The sector was mainly sustained by the mines of Pavlohradvuhillia and Lvivvuhillia, despite regular shelling and power outages at the former’s mines. Coal imports also increased sharply.

Transport: Marathon with Obstacles

In 2025, maritime transport remained a key channel for Ukrainian exports, despite constant missile and drone attacks that damaged over 500 port infrastructure facilities and 116 civilian vessels. The Ukrainian Maritime Corridor has transported over 162 million tons of cargo (including 98 million tons of grain) with the participation of about 7,000 vessels since its operation began. Landmark events included the restoration of regular container lines from Chornomorsk and Odesa ports to Turkey, as well as the partial restoration of ferry connections with Bulgaria and Georgia. Despite security challenges, ports continue to operate, and the implementation of the digital DocPort system began to automate port logistics.

For rail transport, the year was financially and operationally difficult due to falling freight volumes and massive infrastructure shelling. Ukrzaliznytsia recorded a significant decrease in grain transportation (-28% over 11 months) and coal, which, together with the consequences of a powerful seven-week cyber-attack in spring, led to a projected annual loss of UAH 15.4 bn. To maintain financial stability, the company initiated freight transportation tariff increases and reduced administrative staff. Such an increase is still being discussed in the government. At the same time, the sector made essential steps in European integration: a section of European gauge track between Chop and Uzhhorod was opened with EU and EIB financing. Before this, Chop was already connected to the railway networks of neighboring countries via EU-standard gauge.

The automotive sector in 2025 focused on integration into EU standards and border digitalization. The transport liberalization agreement with the European Union was extended until 2027, which obliges Ukrainian carriers to use smart tachographs and comply with European control standards. The eQueue system became mandatory for all trucks weighing 3.5 t or more, allowing businesses to save significant funds by reducing waiting times. However, the implementation of the new European Entry/Exit System (EES) and repair work at key checkpoints, such as Rava-Ruska and Krakovets, caused significant delays and queues at borders in specific periods.

Foreign Trade: Import Surge with No Export Growth

According to NBU data, over 11 months of 2025, goods exports (in dollar terms) fell by 3.5% yoy. The decline reflected the exhaustion of grain and oilseed stocks from previous years’ harvests compared to last year. The decline was smaller than could be expected due to, on average, higher export prices for grain and oilseeds and growth in exports of most other goods groups – both agricultural goods (other than grain and oilseeds) and industrial goods. Growth in exports of mining and metallurgical complex products did not materialize amid stable foreign demand for Ukrainian products and the operation of the Ukrainian Maritime Corridor, due to Russian attacks and global overproduction.

Growth in demand from the defense forces and defense industry, increased import needs of energy and of goods required during electricity outages due to Russian attacks, and the planned cancellation of import benefits for electric vehicles in 2026 led to a sharp increase in imports. Goods imports grew by 22.3% yoy over 11 months of 2025. The most significant increase was in machinery and equipment imports (by 36% yoy). This reflected growing demand for drones and vehicles for frontline needs, as well as for defense industry components. Russian attacks also increased energy imports. Demand for consumer goods grew much more moderately, and import prices for energy were, on average, significantly lower than last year.

State Budget: Domestic Revenues Were Insufficient to Cover Defense Expenditures

Throughout the year, the State Budget Law underwent several significant changes to finance higher-than-expected defense expenditures. This was primarily because the budget was calculated on the assumption of reduced military activity in mid-2025, whereas it only intensified. In addition, Ukraine did not receive the expected in-kind military aid from the US and was therefore forced to shift planned defense procurement to the beginning of the year.

Thus, already in summer, parliament introduced government-proposed changes to the 2025 State Budget Law and increased defense and security financing by UAH 412 bn, which was planned to be financed by UAH 65 bn in savings on state debt servicing, UAH 11 bn in other expenditure cuts, UAH 147.5 bn in additional revenues from personal income tax and corporate profit tax, and UAH 184.9 bn in additional domestic government bond borrowings. Already in autumn, another change was adopted to increase defense expenditures by UAH 300 bn, to which part of the EU loan under the ERA mechanism was directed. Thus, for the first time since the start of the full-scale war, domestic revenues were insufficient to finance the defense and security sectors. Therefore, part of the international aid funds had to be directed there (after coordination with the EU).

Overall, according to preliminary information from the Ministry of Finance, general and special fund revenues of the State Budget amounted to UAH 3,815 bn, which is 22% higher than the 2024 indicators. Thus, revenues from all major taxes increased. Higher wages and an increase in the military levy rate boosted personal income tax revenues. Profits of state banks, which were taxed at a 50% rate, contributed to increased corporate profit tax revenues. Larger consumption contributed to higher VAT revenues. At the same time, lower-than-expected taxable imports in hryvnia equivalent (partly due to a stronger hryvnia than assumed in budget parameters) led to significant underperformance of the import VAT plan. Funds received from domestic government bonds were also lower than the revised plan. At the same time, the government received expected international aid, which helped finance record-breaking expenditures in December.

Overall, as before, over half of expenditures went to defense. Although there was high uncertainty throughout the year, the government continued to finance all existing social programs, as well as business support programs through 5-7-9% credit and grants. Throughout the year, national cashback programs continued, and at the end of the year, the President again announced winter support for citizens totaling UAH 1,000, which is rather a populist program. For vulnerable populations, such assistance amounted to UAH 6,500. The government also allocated UAH 8 bn to Ukrzaliznytsia, which can be considered as compensation for below-cost tariffs for passenger transportation.

Almost all recovery and reconstruction financing in 2025 was covered by international financial organizations within various projects. This concerns projects financed by the World Bank and the European Investment Bank (EIB). During the year, the government implemented a reform of the public investment management system, according to the mechanisms and criteria of which funds began to be allocated for financing projects from the EIB. Also, in accordance with new approaches, financing was allocated from the State Regional Development Fund program. To increase transparency, all projects are now submitted through the DREAM system.

The year ended with the successful restructuring of the GDP warrants, which eliminated the risk of high payments in the event of a rapid post-war recovery. At the same time, the memorandum on the eighth review of the IMF program already mentioned the possibility of re-restructuring Eurobonds that were already restructured in 2024. This is because the war’s active phase continues, and uncertainty remains high.

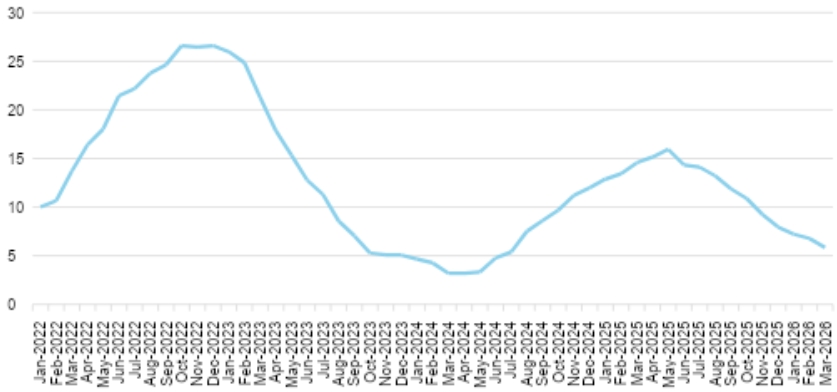

Inflation: Slowdown in the Second Half of the Year

In November 2025, annual inflation fell to 9.3% yoy from 11.2% yoy in November 2024. This reflected an acceleration of inflation that began at 3.2% yoy in April 2024 and peaked at 15.9% yoy in May 2025. Subsequently, inflation gradually slowed.

However, prices in 2025, on average, remained significantly higher than last year’s throughout the year. This reflected both higher costs, including price growth for various groups of goods, which varied quite considerably. In more competitive markets, especially for goods and services whose costs were not a priority for consumers, price growth was very moderate. This concerns, for example, most non-food goods, except medicines and medical goods. For goods with lower competition or where producers could choose between exports and supplying the domestic market (for example, several meat and dairy products), growth was much more noticeable. This applies to most food products, medicines, medical services, and communication services. The government also restrained inflation by maintaining tariffs on several utilities and passenger rail transportation.

In 2026, pressure on prices from costs will likely persist, which will restrain a further slowdown in inflation. The government may also revise some tariffs to improve the situation at Naftogaz, Ukrenergo, and utility companies for water and heat supply.

Figure: Consumer inflation, % year-on-year

Monetary Policy: Balancing Between Restraining Inflation and Supporting Economy

In 2025, as before, the NBU tried to maintain macroeconomic stability amid Russian aggression. To do this, it, as before, focused efforts on restraining inflation and supporting the hryvnia exchange rate, while avoiding excessive pressure on economic activity.

Accordingly, the NBU raised the key policy rate from 13% to 15.5% per annum in the first quarter and kept it unchanged for the rest of the year. This approach was a compromise between restraining inflation and avoiding additional negative impact on already weak economic growth. With a stronger economy, the key policy rate would likely have been higher.

The hryvnia exchange rate to the US dollar at the end of the year was close to the initial level. However, during the year, the hryvnia first strengthened against the dollar and, at the end of the year, returned to its previous level of about 42 hryvnias per dollar. At the same time, the sharp weakening of the dollar against the euro led to a decrease in the hryvnia’s purchasing power in the eurozone by over 13% during the year. NBU interventions to balance private demand for foreign currency and support the exchange rate in 2025 amounted to USD 36.2 bn, slightly higher than the previous year’s indicator of USD 34.8 bn. Due to high volumes of foreign aid, NBU reserves at the end of November 2025 exceeded USD 54.7 bn, up from USD 43.8 bn at the end of 2024.

In line with our expectations, any reduction in the key policy rate in 2026 will be moderate, as the NBU is currently signaling. Given that inflation in Ukraine will remain higher than in trading partners, some weakening of the hryvnia against the dollar and euro is likely. However, given the expected significant inflows of foreign aid and high volumes of international reserves, any exchange rate changes will be managed while maintaining the baseline scenario.

Continue exploring:

Single Labor Market: How Ukraine and the EU Can Transform Competition for People into Partnership

Trends and Tendencies in Participatory Budgeting: City Government and Local Democracy in Budapest