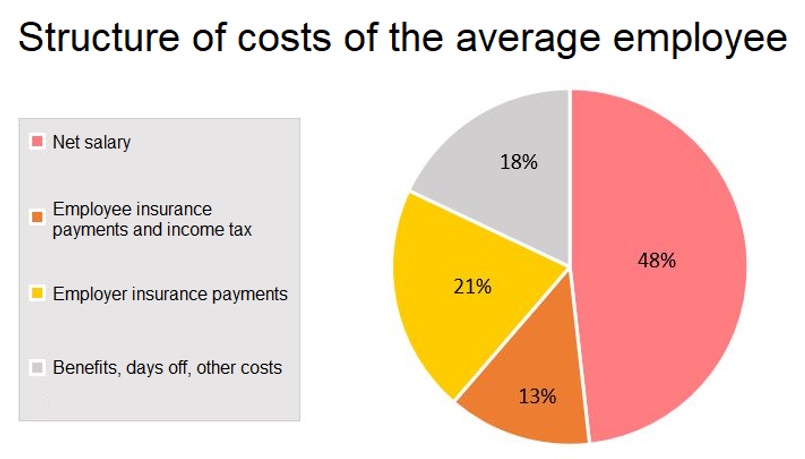

The Liberalni Institute calculated that with an average wage of CZK 40,086, the total cost per employee is 63% higher, i.e. CZK 65,376.

This is the second year of the Cost of an Employee project, which the Liberalni Institut publishes in cooperation with the Slovak think tank INESS and the German FNF Foundation. The aim of the project is to calculate the total cost of a job for different types of employees.

You can calculate the total cost of an employee according to your parameters on the website cenazamestnance.cz.

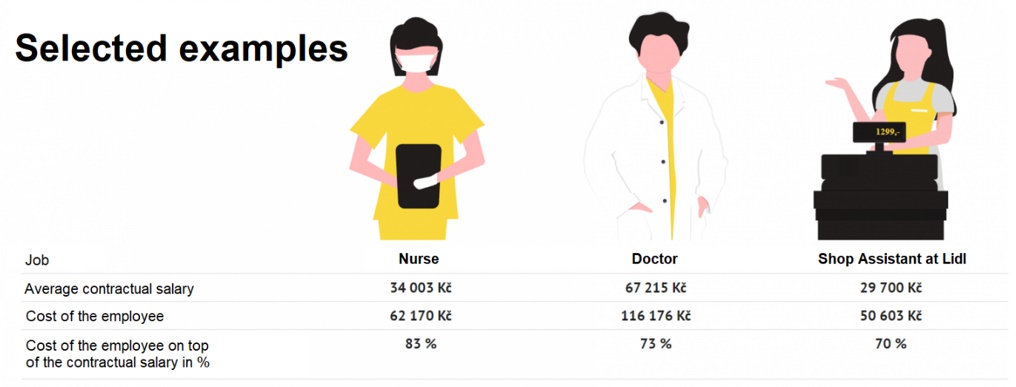

The calculator computes the total cost of labor that an employee incurs, and also shows by what percentage this amount exceeds the employee’s contractual wage. In addition to the employer’s contributions, we also calculate benefits, extra days off, overtime, night shifts, working on holidays, and working in difficult environments. We also take into account, for example, medical appointments, sick leave, the number of weekends per year, and time off for funerals.

On the other hand, administrative costs related to the workplace and the hiring process are not included, as well as other costs associated with th creation of the work environment, such as providing and equipping the workspace, break-room, etc. in short, any costs that are not directly attributable and quantifiable for specific employees. For instance, the cost of an employee with the previous quarter’s average salary, 40,086 crowns, and normal benefits, is 163% of their contractual salary. This is a decrease of one percentage point compared to last year’s calculation.

“Anyone who has ever been employed is well acquainted with mandatory social and health insurance and the income tax,” comments Jan Mosovsky, the project’s manager and Research Director at the Liberani Institut. “But beyond that, there are other costs, such as insurance payments paid on the employer’s side, employee benefits, or sick leave, for example, which further increase the amount an employee must earn through his or her activities to make the company’s job worthwhile.”

“Net pay is only half of the total cost of our work. So for every second day we work, we don’t see a reward in our wallet,” says Martin Pánek, Director of the Liberalni Institut.

“Not all employee costs included in the project can be considered a tax – for example, food stamps. The aim of the project is not to point out the tax burden – that is the focus of our Tax Freedom Day and Tax Burden projects – nor necessarily to criticise the legal protection of employees, but to increase the transparency of the actual costs of a particular job,” adds Jan Mošovský, the project’s lead analyst.

Along with the calculator, selected examples have been updated. For better comparability, the parameters of individual selected professions (overtime hours, days off) have been retained from the previous year, while the average wage for the professions has been updated. As with the average employee, we observe no or only a one percent difference in the value of an employee above the contractual salary compared to last year.

“Many of the parameters affecting the cost of employees have not changed year-on-year,” Mošovský comments on the stability of the results. “The slight variations are mainly due to the increase in average wages and the change in the number of working days per year due to the greater coincidence of weekends and public holidays, and from government policies only the renewed increase in the income tax rebate. The last major step that would affect the Cost of an Employee was the abolition of the so-called super gross pay, which was already factored in last year’s version of the project. The current government’s policies to increase business taxes will be reflected, for example, in the Tax Burden, where we take into account the taxes people pay as customers, but will not affect the Employee Price.”

Continue exploring:

Butter on Head of Madeta’s Boss

Are Energy Prices Main Reason for Difference in Inflation between Poland and Other EU Countries?