Grexit at the Gates! – Fiat Euro! 19/2012

BY

Juraj Karpis / May 16, 2012

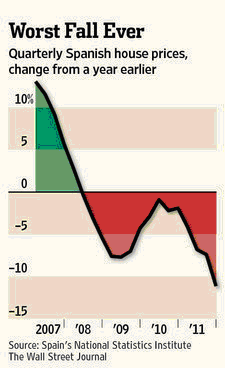

Voters decided if they still want to live on others‘ money. Savings or growth? A false dilemma with irresistible sex appeal to politicians. The Golden Dawn in Greece. Why Hugh Hendry is concerned about his assets in Europe? In Spain thr nationalization of banks‘ debts is launched – will they manage to break record annual deficit […]