When is going to happen the next Slovak cabinet billion-worth meeting? Is Draghi tough because Angela is on hliday? Will be two Greek bankrupts within six months a new European or Olympic record?

What a week! When it come to euro crisis, there is no silly time for sure. For example, how many Slovak cabinet meetings, during which our representatives approved 1 billion EUR for a Spanish black hole, have there been before? For example, the whole fiscal consolidation, we are going to painfully pay with next year’s new taxes for, should be worth 1.2 billion EUR. Each raised hand of the 14 members of the government cost 71 million EUR. Meanwhile, we do not have Money to pay bills at home.

Spanish firemen protest in Bilbao against austerity.

Everybody probably knows, that some 100 billion won’t save Spain. At least the markets know it, which sent the Spanish bond yields to record 7.6%, in the time, when Slovak government was voting on the bailout. According to RBS, Spanish bailout request is a question of days (during writing of this article, a news about Spain asking for 300 billion help appeared). Angela and pandas are on holiday, ESM is in a drawer at German constitutional court, and a panic is slowly coming to the markets. What to do? Eurozone should be once again saved by ECB representatives. They used the only unlimited source they have – promises.

The first testing balloon was released into the air by European Central Bank (ECB) Governing Council member and Austrian central bank head Ewald Nowotny Najprv. He “accidentally” started to think loud in presence of journalists about the advantages (bypassing the dysfunctional banks and a pile of new EUR for bond purchases), which would come with a banking license for ESM. Another board member came to help. Benoit Coeure announced to the world from Mexico, that “I would caution those who have doubts about the euro, that they underestimate the political commitment to it at their own risk,” And the exclamations of cheap coordinated verbal monetary policy was topped by ECB chief Draghi. “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough,” he said on the last Thursday during a London conference for investors. “To the extent that the size of the sovereign premia (borrowing costs) hamper the functioning of the monetary policy transmission channels, they come within our mandate,” he said. Translated to human language: “If the situation becomes really bad, we will start printing euro and buyin sovereign debt!”

10-yar Spanish bonds yield (Friday 27/7/2012):

This announcement sparked market euphoria lasting several hours, cut down the Spanish bond yields by more than 100 basis points and also helped Italian bonds substantially. But it’s one thing to make promises and a different one to keep them. Bloomberg notes, that Draghi pushes himself with these announcements in a corner. Markets won’t be satisfied by words soons, they will want to see the fresh euro, and ECB will have to act. „Show me the Money!“

Almost immediate “Nein!” from the Bundesbank shows, that Draghi promises something he may not be able to fulfil. German central bank let the markets dream about a flood of new euro and debt monetization for about 24 hours. Then an official announcement came, in which it confirmed its previous attitude refusing sovereign bond purchases, which erase the difference between monetary and fiscal policy.

Moodys agency assigned negative outlook to German rating, concerning the threatening bounds to the rest of the eurozone (and also moved the EFSF to negative territory). German government disapproves this decision. According to the ministry of finance, Germany is “in a very sound economic and financial situation,” what financial markets confirm by regarding Germany as a safe haven, accordin to the ministry. However beware, according to the Minister Wolfganga Schaeuble “The current levels of interest rates on sovereign debt markets don’t correspond to the fundamentals of the Spanish economy.” Markets are wrong. That may be truth, the situation is probably even worse than it seems. However, if the markets correctly see Germany as a safe haven, and on the other side they incorrectly see Spain, the question for the German minister is: “So are the markets correct, or no?”

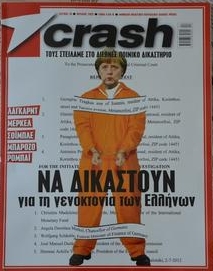

Greek magazine Crash wants to trial german chancellor for a “murder of nation“. Such headlines won’t help much in negotiations of the third rescue package. Yes, you read it correctly, Greeks need more money or another bankruptcy. Who could have known? By the way, did you know, that after two years of Troika supervision, one default, and loans also from Slovak taxpayers still pay 13th and 14th pay to public employess and to chosen pensioners?

Seems they are making fun of us.

Enjoy planned 20-minute fireworks in just 15 seconds.

Holiday explosion of experience wishes

Juraj Karpiš