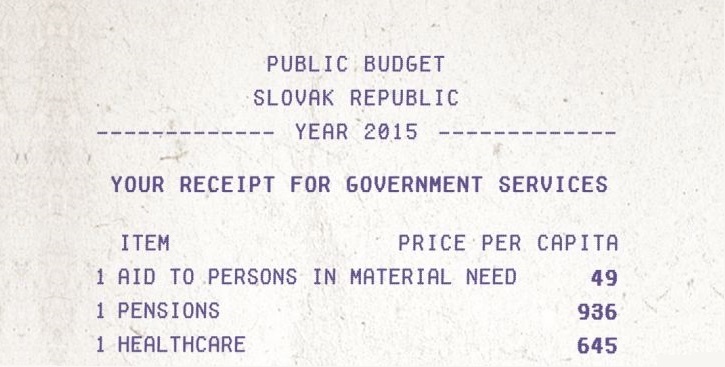

Slovakian Bill for Government Services

BY

Richard Durana / June 2, 2015

Just like every year, INESS released the Bill for Government services few days ago. Although such information should be ideally provided by the government itself, Slovak government is somewhat reluctant to inform the society on costs of the functioning of the state. This is precisely why INESS decided to take up this task.