Why Conduct the Annual Survey of Business?

BY

Igor Burakovsky AND The Institute for Economic Research and Policy Consulting - Kyiv / December 11, 2017

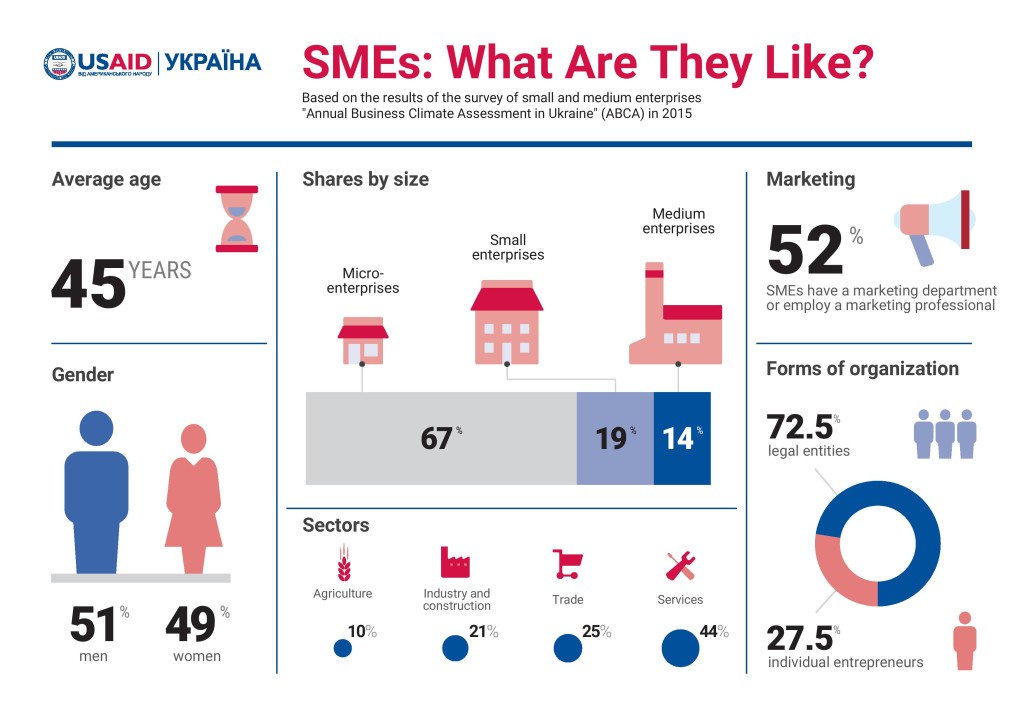

In October, the USAID Leadership in Economic Governance (LEV) Program held its final event. The project lasted for three years and made an important contribution to the policy of small and medium enterprises (SMEs) development in Ukraine.