While higher taxes cause immediate pain, numerous fees can be hidden in prices of products with anybody hardly noticing. For example, in the consumption prices of electricity.

Traditionally a strong topic of electricity sector has claimed a lot of attention in Slovakia in recent years. A few related motifs have appeared – high final prices of electricity, problems of energy-intensive enterprises, support or (reversely) taxation of renewable energy sources, support for mining, threat of closure of Vojany and Nováky thermal power plants and so on. Whereas the question of the final electricity price affects directly practically the entire economy of Slovakia, it can be regarded as the key aspect.

Prices: High or Not?

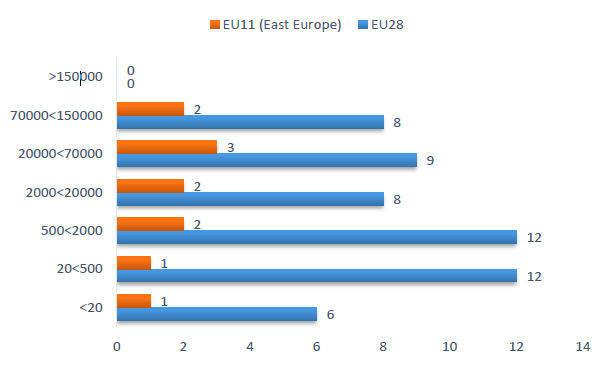

Since 2014, several squabbles with regard to end-user prices of electricity in Europe have taken place in the public debate between the European Commission and employers on the one hand, and the Office for Regulation of Network Industries (ÚRSO) on the other. No matter how good is the Eurostat’s methodology, alternative data (e.g. from the Europe’s Energy Portal) also indicate that the end-user electricity prices for business customers are among the highest in the Central and Eastern Europe.

The rank of Slovakia in the end-user prices of electricity (1=the most expensive, 0=no data) in a variety of consumption bands (MWh/year) for the second half of 2014.

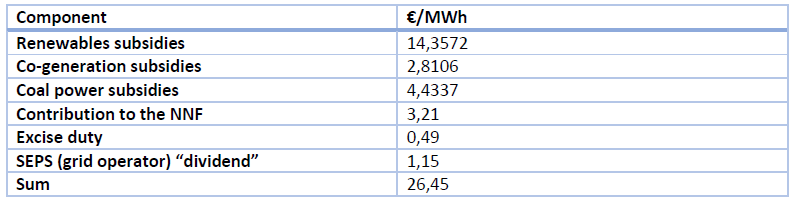

Electric Tax May Be Responsible

A systematic concealing of environmental or social policies into the electricity prices is one of the causes of high prices. INESS has attempted to quantify the effect by introduction of the imaginary “Electric Tax”, which reached the value of €26.45/MWh. This means that the “Tax” amounts to €60.8 or 16.3 percent of the total annual expenditures on electricity in a normal household consuming 2.3 MWh per annum. To show a comparison: if all this year’s predicted fiscal losses on reduced VAT (Slovak government reduced VAT on some food staples from 20% to 10%) are transferred to households, they will save approximately €38 per annum.

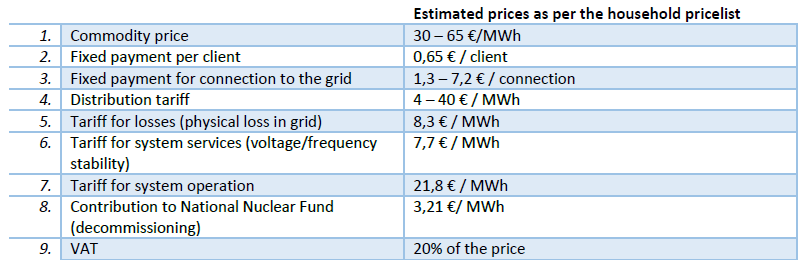

Let’s look at the components of the final electricity price for households which can help us to decompose the Electric Tax.

The structure of final electricity prices for households (VAT excl.).

Source: Pricelists of ENEL and ZSE valid in 2015.

Source: Pricelists of ENEL and ZSE valid in 2015.

The first 5 items are the so-called “eligible costs”, which have been always associated with the electricity production and transmission. Questions arise mainly in the case of Tariff for system operation (TPS) that hides lots of surprises. Besides these 9 components, at company’s electricity bill appears an additional item called “excise duty on electricity” set at €1.32/MWh for business consumers.

Why we separate just these items?

Subsidies for renewables and co-generation (subparts of TPS) – though these subsidies are hidden under the term “system operation”, they do not have much to do with that. These costs of environmental policy are not necessary for commercial operation of production, transmission and distribution of electricity.

Subsidies on domestic lignite power generation – these subsidies are used for keeping approximately 4,000 jobs in mines in central Slovakia that supply economically inefficient thermal power plant in Nováky (ENO). Apart from paradoxical inefficiency (via renewables’ subsidies Slovaks pay €144–€270 per tonne of carbon dioxide saved, and also €42 to ENO to produce that tonne of emissions again), it constitutes a social policy, not a necessity for electricity market operation.

National Nuclear Fund contribution – The NNF collects funds for current (A1 and V1 nuclear power plants) and any future decommissioning. It has three revenue streams: European funds, fees collected from current nuclear power plants operators and contributions collected from all consumers. While fees collected for each installed MW from operators of the nuclear power stations V2 and Mochovce for their future decommissioning make sense (although the credibility of future cost calculations can be always doubted), levy paid by consumers for each consumed MWh regardless of whether it comes from photovoltaic cell or hydroelectric power plant is the outcome of former policy mistakes. Politicians ignored the necessity to form reserves for decommissioning. More transparent would be to include this burden, which is a direct result of political decisions (and the result of state ownership of plants which allows to ignore future) into the budget.

Excise duty – excise duty is the result of the EU’s effort to transfer tax burden from labor to consumption and at the same time to create pressure to slow down the growth of electricity consumption. Slovak governments ignored this idea and introduced the tax without cutting down labor taxes and levies. Additionally, the tax was put in place in such a form in which its administration costs and revenues are literally cancelling each other. If the duty cannot be cancelled at the European level (since it is a bizarre relic full of various national exceptions and with practically zero fiscal significance), lowering its rate and especially higher set eligibility ceiling (to the level matching the monthly consumption of at least 50 MWh) will help. Thanks to that, thousands of small-scale enterprises would be exempt from the unnecessary administration and costs related to the compliance with this duty. While the excise duty rate is €1.32/MWh for business, we distributed the cost on the total consumption (businesses+households) and recalculated the rate, since the higher cost for businesses cascades down to the whole economy.

“Dividend” of SEPS – We could not quantify the “natural” dividends of energy enterprises in an alternative world, where they are not co-owned by the state. Therefore it is impossible to tell, if the state uses its position to artificially increase the profit of the companies to extract higher dividends. However, the grid operator SEPS, which administrates a spinal high-voltage network, is 100-percent owned by the state. Thus we can compare the theoretical situation in which SEPS does not pay any dividends and generates profit required only for financing of average investments and reserves. The purpose of state-owned firms should be to provide a clearly defined public good. Profitable market activities should belong to private companies. However, governments are using profits of SEPS (which end up in the general budget) for funding of various policies and are taking the dividend each year. The average expected annual dividend yield for the state budget from SEPS is €32.8 million in the period of 2008-2017. Considering the average annual consumption of 28,500,000 MWh, consumers pay €1.15/MWh to the state as a “dividend” for each consumed MWh of electricity. If the state has not requested dividends from SEPS, it could lower the cost of the network operation.

The Electric Tax elimination would reduce the price of electricity by more than €26 per MWh and therefore help to increase the competitiveness of the Slovak economy and increase the transparency of various policy costs. The costs which are currently hidden in the Electric Tax would have to be moved into the state budget. This could be financed by cutting inefficient expenditures on some other policies which are currently present in the budget.

The Electric Tax is a hidden but tangible financial cost. Investors in the energy sector often must face even worse “intangible” obstacles. These include the constantly changing environment (during the past few years, investors had to face several sudden swings in the fee structure and regulatory environment). The ÚRSO plays a role of a negative hero which either makes unpredictable decisions or publishes them inadequately to the community. Cooperation with governments used by the energy sector to meet the actual political objectives forms a combination which significantly hinders investment and innovation in the sector.

This is why we formulated the following recommendations for economic policy in the energy field:

-

Terminate the usage of energy sector as a quick and cheap source of money for financing government’s plans.

-

Avoid any direct or indirect subsidization of new energy sources.

-

Eliminate the Electric Tax, finance the political intentions via budget and minimize the economic damage.

-

End the price regulation for supply to households and SMEs.

-

Create a long-term strategy for the energy sector in cooperation with partners.

Adherence to these recommendations would help the development of the Slovak electricity market in the long term.

The presented article is an overview of the new INESS analysis titled Electric tax: State interventions influencing electricity prices in Slovakia.

Full text in Slovak can be downloaded as pdf on http://iness.sk/energia/.

Translated by Peter Adamovsky