The now famous phone call between President Trump and President Zelensky released to the public in September attracted most attention around the Biden affair and possible links to US military assistance. Less noticed were Trump’s remarks that Europe did nothing for Ukraine, notable by comparison with the US.

This prompts us to put the facts together, and to compare the financial assistance from the EU and other donors in the period since the 2014 – see Table 1 for the EU and Table 2 for international agencies and bilateral donors other than the EU.

EU Assistance

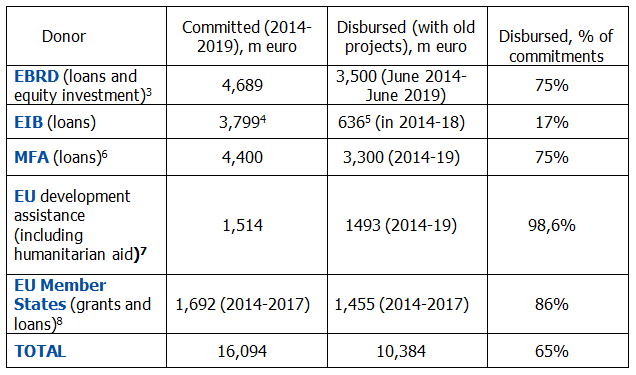

In March 2014, the EU announced a large support package for Ukraine. Originally, all measures combined (overall development assistance, macro-financial assistance, EBRD and EIB loans) could bring over 11 bn. euro. However, the amount of EU commitments has grown to about 14.4 bn. (See Table 1).

In addition, the EU Member states have committed about 1.7 bn. euro of development assistance in 2014-2017, making a total of 16.1 bn. euro.

At the same time, the total amount of disbursements has reached only about 10.4 bn euro (63% of commitments). This figure includes also disbursements of “old” pre-2014 EBRD and EIB projects, which the Ukrainian government and municipal bodies and private companies continue to implement.

Therefore, in reality the amount of disbursements by projects committed in 2014-2019 might be lower, but open sources do not contain sufficiently detailed information on EBRD and EIB disbursements.

Between 30 June 2014 and 30 June 2019, the amount of the EBRD2 disbursements (loans and equity investment) reached about 3.5 bn. euro. This figure makes 75% of the total EBRD commitments.

However, the share of disbursements of ‘old’ projects is not clear. According to the EBRD Financial Report, the amount of undisbursed commitments was 1.7 bn. euro at the end of 2018.

Ukraine is not doing well in implementing projects financed by the EIB. In 2014-2019, the EIB and its partners in Ukraine signed projects worth of 3.8 bn. euro.

However, the share of disbursed commitments is very low, since the Bank disbursed only about 0.6 bn. in 2014-2018. The EIB portfolio in Ukraine is dominated by public sector projects (municipal infrastructure and transport, educations, transport, etc.) Ukrainian government and municipal bodies probably lack capacity to implement signed projects. At the end of 2018, the EIB had 3.5 bn. euro of undisbursed loans in Ukraine.

Since 2014, EU committed 4.4 bn. euro under four programs of macro-financial assistance to Ukraine. Of this Ukraine did not yet receive 600 bn. euro of the third MFA program, since it did not to fulfil its obligations. In addition 500 m euro of the fourth MFA program remains to be disbursed.

The European Commission has committed about 1.5 bn. euro of grants for development assistance and humanitarian aid since 2014. These commitments have been fulfilled, since almost of this has been disbursed.

Finally, governments of EU Member States also assisted Ukraine with grants, loans, and equity investments. In 2014-2017, the value of such commitments reached about 1.7 bn. euro, of which about 1.5 bn. euro was disbursed (86%).

Grants constituted the major part of the commitments (about 1.3 bn. euro, 1.2 bn. disbursed,); loans amounted to 367 mn. euro (217 disbursed), and equity investments about 5 mn. euro (the whole sum disbursed).

Germany was the major donor with about 1 billion euro commitments and 786 mn. euro of disbursements. Among other major donors, there were Sweden – 122 mn. euro of disbursed grants, Poland – 118 mn. euro, United Kingdom – 106 mn. euro, and France – 62 mn. euro.

Table 1: Assistance of EU Institutions, European Financial Institutions and EU Member States

Other Donors

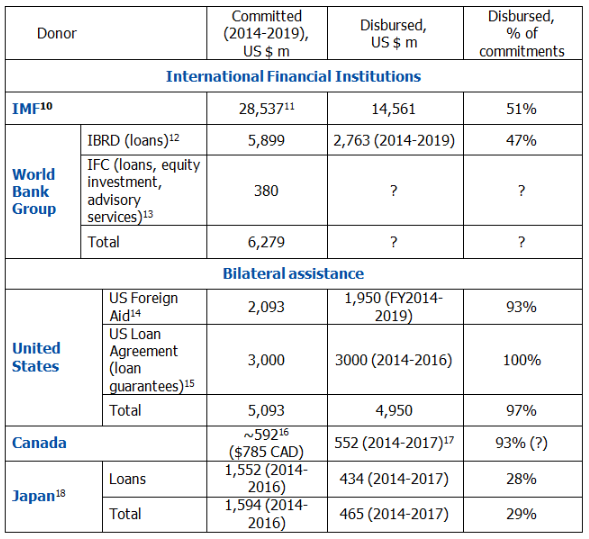

In April 2014, the IMF Executive Board Approved a 2-year stand-by arrangement (SBA) with Ukraine that amounted about $17 bn., under which the IMF disbursed $4.5 bn. In March 2015, 4-year Extended Fund Facility, worth of $17.5 bn., substituted the 2014 SBA. Under this Ukraine received $6.6 bn. in 2015, $1 bn. in 2016 and $1 bn. in 2017. The arrangement was suspended due to lack of reforms.

In December 2018, the IMF Executive Board approved a 14-month SBA that amounted about $3.9 bn., under which Ukraine managed to receive only $1.4 bn. for immediate disbursement.9 In total, the IMF disbursed $14.6 bn. to Ukraine (51% of commitments) (see Table 2).

Table 2: Other donors

The World Bank Group, including IBRD and IFC, has offered loans to Ukraine’s public and private sector. Since 2014, the IBRD Board approved projects in public sector worth of $5.9 bn. Within the framework of these projects, disbursements reached $2.8 bn as of end September 2019 (47%). The implementation of municipal and infrastructure projects is rather slow.

In addition, the IFC supports the development of the private sector in Ukraine. Its investment reached $350 mn. (predominantly loans, only $15 mn. are for equity investment).The amount of disbursements is not available in open sources.

The United States has provided about $5 bn. of bilateral assistance. In 2014-2019 fiscal years (data for 2018-2019 may be incomplete). Of this total there was grant assistance of about $2 bn. (including military aid), and three $1 bn. loan guarantee agreements.

The Japanese government have committed circa $1.6 bn, predominantly loans (97%). However, the volume of disbursements reached only $465 m. (including $434 mn. of loans). The main project is the $1 bn. Bortnychi Sewage Treatment Plant Modernization Project. The project is ongoing and modernization should be finished by 2025.19

Canada has also become one of the major Ukraine’s donors. Since January 2014 its commitments have reached more than $592 mn. (CAD 785 m). In 2014-2017, Canada disbursed $552 mn., including two loans worth of $338 mn. (CAD 400 mn.).

Conclusions

The largest single supplier of financial assistance to Ukraine since 2014 has been the IMF through commitments of macro-financial loans totaling $28.5 bn.

The second largest contributor has been the EU, with 16 bn. euro of commitments, combining its grant and loan assistance with those of its member states, and loans and investments by the EBRD and EIB.

In third place comes the World Bank group, with commitment of $6 bn. of loans and investments.

In fourth place comes the United States with commitments of $5 bn., followed by Japan and Canada.

Disbursements so far under these commitments are largely complete for grant assistance, but much less so for loans for two understandable reasons.

First, the macro-financial loans are subject to policy conditions that have not yet been entirely met.

Second, loan assistance for infrastructure projects have long lead times for preparation in the best of circumstances. However, Ukraine’s public bodies still have weak implementation capacity unlike the private sector that is taking advantage of the opportunities.

Note on Sources

The calculations are based on data from open sources, including annual reports of financial institutions, development assistance databases, official infographics, statements, project lists and summaries. Because of publication lag, data are only partially available for 2018 and 2019.

This publication is prepared within the framework of the CEPS-led “3DCFTAs” project, enabled by financial support from Sweden. Views expressed in this publication are attributed only to the authors, and may not be attributed to either the partner organization of the project or the institutions to which they may be attached, or the Government of Sweden