Value-added-tax (VAT) is the most important source of public revenue in Poland. It is less distortive than taxes levied on income and thus a heavy reliance on it is the right approach. However, the VAT base in Poland has its weaknesses due to both domestic and EU polices. National authorities overuse reduced rates, making the VAT system too complicated and problematic for businesses while a zero rate on intra-EU trade incentivizes fraud.

An Overview of the Polish System

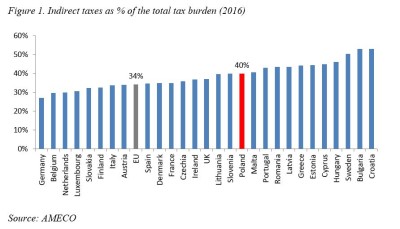

VAT constitutes a major revenue stream for the Polish government. In 2016, VAT alone constituted 21% of the tax burden while its combination with excise duties and other indirect taxes totaled to nearly 40% of the tax burden, exceeding the EU average of 34%. Such a heavy reliance on indirect taxation is a strength of the Polish tax system. Research shows that indirect taxes like VAT are less distortive than income taxation and therefore have lesser effect on economic growth (e.g. Arnold 2008, Johansson et al. 2008, Ormaechea & Yoo 2012). Moreover, behavioral research signifies that consumption-related taxes are less detrimental to the supply of labor compared to direct labor taxation (Blumkin et al. 2012).

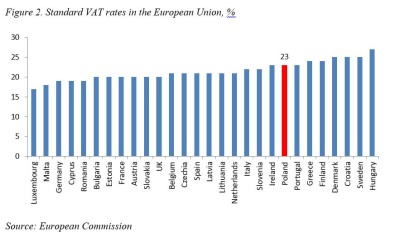

A sizeable VAT revenue is the result of a high standard rate. Currently, the standard VAT rate in Poland stands at 23% and is among the highest in the EU (Figure 2). In theory, the standard rate is 22% as it was “temporarily” increased 2011 for the period of three years. However, there is no political will to re-introduce a lower rate.

Overuse of Reduced Rates

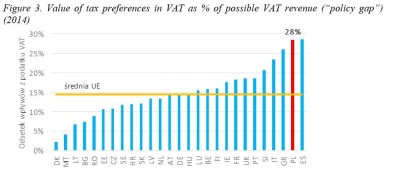

Despite a relatively high rate, VAT revenue in Poland is far lower than it could be due to many exemptions and a long list of goods subject to reduced and super-reduced rates. According to estimates by CASE, policy gap (the tax expenditure in VAT divided by VAT revenue that could be expected when standard rate would be applied to all goods and services) in Poland is among the highest in the EU.

Soruce: CASE, Study and Reports on the VAT Gap in the EU-28 Member States: 2016 Final Report, Center for Social and Economic Research, Warsaw 2016, https://ec.europa.eu/taxation_customs/sites/taxation/files/2016-09_vat-gap-report_final.pdf

The size and scope of tax exemptions in VAT in Poland are unjustified. More than half of the VAT preferences are supposed to support low-income households, but such support is not targeted and thus highly inefficient. While low-income households (10% of the poorest households in Poland) gain around PLN 4 billion annually (approximately EUR 1 billion), the annual income of the most wealthy (10% of the wealthiest households in Poland) is close to PLN 11 billion (approximately EUR 2.5 billion).

There are two reasons for this. In case of basic goods (e.g. food), wealthier households have higher consumption, thus in nominal terms they gain more from lower tax rate. Furthermore, lower VAT rates also apply to many goods and services consumed mainly by wealthier households (e.g. gastronomy and accommodation services, theater tickets, books, and magazines).

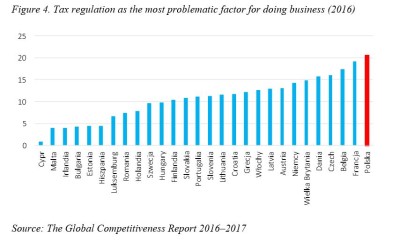

Many exemptions make the Polish VAT system particularly complicated. The problem is further exuberated by frequent changes. For example, although the majority of food is subject to a reduced rate, some spices, sauces, and drinks are not. A hot dog, consisting of a roll, a sausage, and sauce can be taxed in more than twenty ways, depending on:

-

the expiration date of the roll as rolls with different expiration dates are subject to different tax rates: 5, 8 or 23%;

-

the sauce used – for example, mustard is subject to a 23% rate while ketchup and mustard sauce (!!) and some others like pepper, salt, etc. are subject to a 8% rate.

Such differences encourage companies to search for loopholes that allow them to apply the lowest possible tax rate to goods and services they offer. Simultaneously, the Ministry of Finance constantly tries to close such loopholes; however, without changes in the underlying principles, the Ministry fails to do so.

Taxation of coffee is a good example of a cat-and-mouse game played by taxpayers and the Ministry of Finance. Although coffee is subject to a 23% rate, until recently coffees with greater amount of milk (e.g. latte) were considered milky products subject to reduced rates. After the Ministry has issued a binding interpretation that all coffee products are subject to a 23% rate, many coffee shops changed their approach. Instead of selling coffee drinks, they started offering packages with tiny biscuits, where 90% of the price is attributed to the biscuits (reduced tax rate) and only 10% to the coffee. The underlying problem is that policy-makers try to apply different rates to virtually identical goods using vague criteria. As a result, tax regulations are unpredictable.

In the field of optimal tax theory there is a consensus that exemptions from indirect taxation are inefficient means of redistribution (e.g. discussion in Mirrlees Review1), but political reality in Poland (and many other countries) is different. All attempts to limit or eliminate reduced VAT rates in Poland are demonized as an attack on the poor. It should be noted, however, that occasionally aired in public debate ideas to introduce a single VAT rate (mainly by smaller opposition parties) are usually poorly designed. A recurring idea of a single rate of 15% or 16% (it would be fiscally neutral) would disproportionately affect poor households whose consumption is rather limited to goods and services subject to reduced rates.

Therefore, there is a need for reforms that simultaneously make the system simpler, strengthen incentives to work, and would not make poorer households worse-off. The introduction of a single rate of 20% or 21% would be a good idea as the resulting revenue could be used to reduce labor taxation at the lower end of the scale (taxation of low productivity/low income workers).

VAT Fraud and Intra-EU Trade

VAT revenue in Poland is significantly lower than one would expect taking into account the current tax law. CASE (2016) defines VAT gap as a difference between VAT Total Tax Liability (VTTL), which is the theoretical tax liability according to tax law, and is estimated using a top-down approach and the actual VAT revenue, expressed as percentage of VTTL. In 2014, CASE estimated a 25% VAT gap in Poland which was among the seven highest in the EU.

The size of the VAT gap was a serious topic in 2015 electoral campaign – the then main opposition party (Law and Justice, PiS) accused the ruling PO-PSL coalition of negligence. In fact, the VAT gap grew strongly from 2000 through 2015. With the new government claiming a huge success, today there is a strong increase in VAT revenue; however, it is mainly the result of:

-

the composition of GDP growth – both in 2016 and first half of 2015 private consumption was the main driver of growth, despite falling private investment. As VAT is levied on consumption rather than private investment, such growth results in high VAT revenue;

-

the current business cycle – the Polish economy is currently in upswing and previous experience shows that during upswings VAT revenue grows faster than the economy;

-

policy actions – better monitoring of the fuel market and other actions taken by the new government might have discouraged some fraudsters;

-

misleading accounting – in December 2016, the government accelerated the repayment of excess VAT to business, which enabled reporting record net revenues in January and February 2017.

A reliable evaluation of the real effects of the recent governmental actions will be possible only after the next cyclical downturn. Only then will it be finally revealed how much of the recent improvement in VAT collection was structural and how much only due to cyclical factors.

As the size of VAT gap was a subject of a public debate during the last election campaign, it was mainly attributed to fraudsters and intra-EU trade (e.g. missing trader scheme). Definitely, as experience of other EU countries indicate, a zero per cent VAT rate on intra-EU trade incentivizes fraud which does not only undermine public revenue, but also distorts competition as companies that cheat gain an advantage over their law-abiding competitors. However, according to the estimates by Poniatowski et al. (2016), only 11% of the VAT gap was due to a missing trader, while 32% was due to refund overstatement (based on the use of unauthorized invoices). Still, the authors were unable to allocate over 40% of the VAT gap to a particular source – it could be both shadow economy as well as fraud relating to intra-EU trade.

Conclusions

The present overuse of reduced rates by national authorities coupled with a zero per cent rate on intra-EU trade stemming from EU regulation makes the VAT system in Poland particularly complicated and prone to fraud. The best solution would be to introduce a single rate for domestic purposes (with proper compensation for the poorest households) coupled with the establishment of a definite VAT regime in the EU that would eliminate the zero rate. As it was argued earlier, however, at present, there is no political will in Poland to introduce a single VAT rate. Similarly, at the EU level, there is no consensus how the VAT system should look like; therefore, a transitional regime established two decades ago is still in place.

References

J. Arnold (2008), “Do tax structures affect aggregate economic growth? Empirical evidence from a panel of OECD countries”, OECD Economics Department, Working Paper No. 643

Blumkin, T., Ruffle, B.J., Ganun, Y. (2012), Are income and consumption taxes ever really equivalent? Evidence from a real-effort experiment with real goods, European Economic Review 56(6): 1200-1219.

A. Johansson, C. Heady, J. Arnold, B. Brys, L. Vartia (2008), “Taxation and Economic Growth”, OECD Economics Department Working Papers, No. 620, 2008;

S. A. Ormaechea & J. Yoo, (2012).”Tax Composition and Growth; A Broad Cross-Country Perspective,” IMF Working Papers 12/257, 2012.

CASE (2016) Study and Reports on the VAT Gap in the EU-28 Member States: 2016 Final Report, Center for Social and Economic Research, Warsaw, https://ec.europa.eu/taxation_customs/sites/taxation/files/2016-09_vat-gap-report_final.pdf

Poniatowski, Grzegorz and Neneman, Jaroslaw and Michalik, Tomasz, VAT Non-Compliance in Poland Under Scrutiny (June 28, 2016). mBank – CASE Seminar Proceedings, No. 142/2016. Available at SSRN: https://ssrn.com/abstract=2813160 or http://dx.doi.org/10.2139/ssrn.2813160