COVID-19 reached Poland a few weeks later than Western Europe, to which the Polish government responded promptly by introducing a nation-wide lockdown. Administrative restrictions to constrain the spread of the virus coupled with reactions of wary consumers led to economic disruptions that peaked in April 2020. This paper presents data showing how COVID-19 affected companies in Poland and discusses policy responses to it.

The first part of the paper points to the strengths and weaknesses of the Polish economy on the eve of a pandemic. In the second and third parts, the paper portrays both steps taken by the Polish government to limit COVID-19 spread and economic policy responses aimed at mitigating economic fallout due to a pandemic. In the fourth part, it presents how the overall situation of companies changed during the pandemic.

In contrast, the fifth part discusses in detail the most pressing issues for companies at the height of the lockdown. In the final part, the paper discusses the efficiency of a policy response to the problems faced by companies and what macroeconomic effects can be expected.

Strengths and Weaknesses of the Polish Economy Facing COVID-19 Pandemic

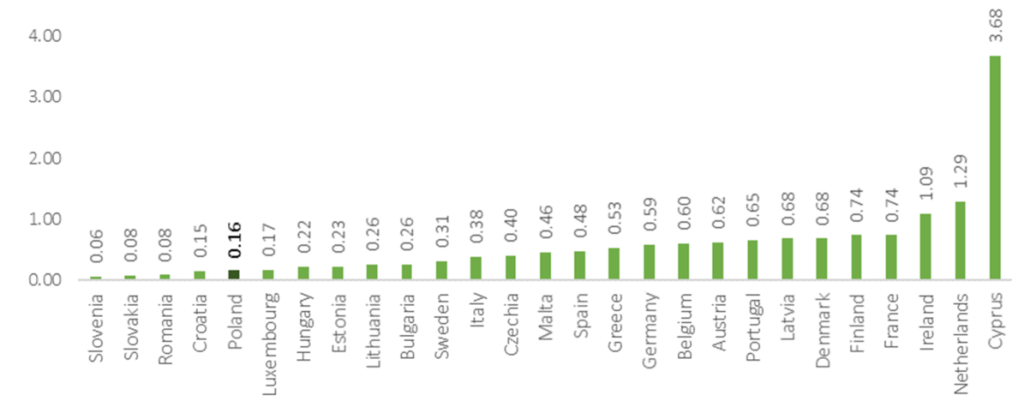

Later arrival of Covid-19 in Poland could be a result of weak international connections (see Figure 1). In Poland, the first case of COVID-19 was recorded on March 4, 2020, which is over a month later than in Western Europe, where the virus was confirmed at the end of January 2020. However, recent reports from France indicate that COVID-19 might have been present there as early as December 2019.

Although after 30 years since the fall of communism, Poland has moved from the periphery of the global economy much closer to its center, it is still poorer and less globalized than Western peers. Fewer passengers of transcontinental flights could have delayed the arrival of COVID-19.

Figure 1. Passengers of trans-continental flights per population, 2018

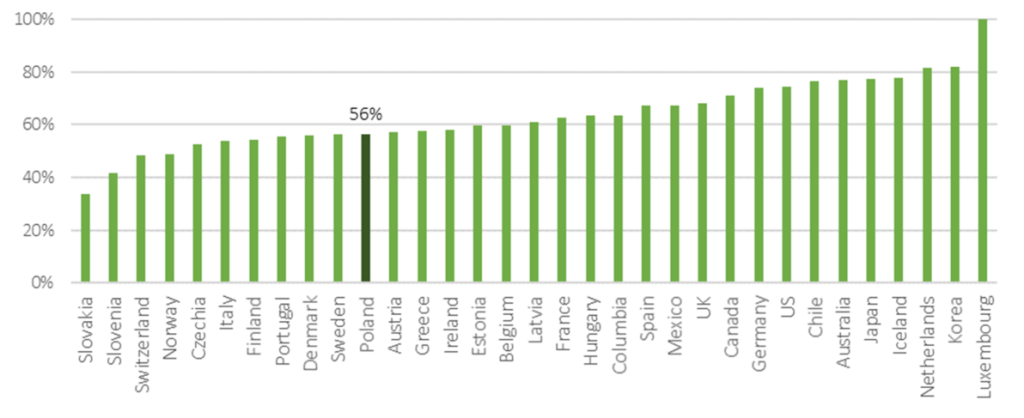

Slow spread of COVID-19 in Poland could be a result of a low level of urbanization (see Figure 2). Compared to other highly developed OECD countries, Poland’s low level of urbanization might have slowed the spread of the pandemic, as around half of the cases were recorded in just two voivodeships in Poland: Silesian (Katowice agglomeration) and Mazovian (Warsaw).

Along with low level of urbanization, Poland also benefited from relatively low share of the most vulnerable to COVID-19 people aged 65 and more in Poland is below the EU average (17.7% vs. 20.3%) and far below of the Italian average (22.8%).

Figure 2: Share of population living in urban areas with 50 thousand or more people, 2015

Structure of the Polish economy put Poland in a favorable position compared to the majority of Western European peers. Tourism does not contribute significantly to the Polish GDP. Among OECD countries, only in Luxembourg tourism generates smaller part of GDP than in Poland (OECD 2020).

Further, Polish manufacturing is well diversified. Compared to regional peers, Polish economy is less dependent on the global automobile industry, which suffered significantly from both distortions in supply chains and contracting demand.

The state of both healthcare and bureaucracy, coupled with burdensome regulation, has been the main weaknesses of Poland in the wake of a pandemic. The poor state of Polish healthcare has been an ongoing issue for years, concerning both sizes of public expenditure (4.8% GDP in 2018 vs. EU average of 7.1%) and the efficiency with which those resources are used.

A limited capacity of healthcare system can be illustrated by a low share of doctors in the population (practicing physicians per 100 thousand inhabitants in 2017: PL 238 vs. EU27 361) that could become a bottleneck in case of massive breakout of a pandemic.

Concurrently, weak bureaucracy and complicated rules (according to World Bank Doing Business, Polish tax system is the second most time-consuming in the EU) have limited government’s capacity to efficiently introduce and administer COVID-19 recovery packages.

Lockdown and Social Distancing

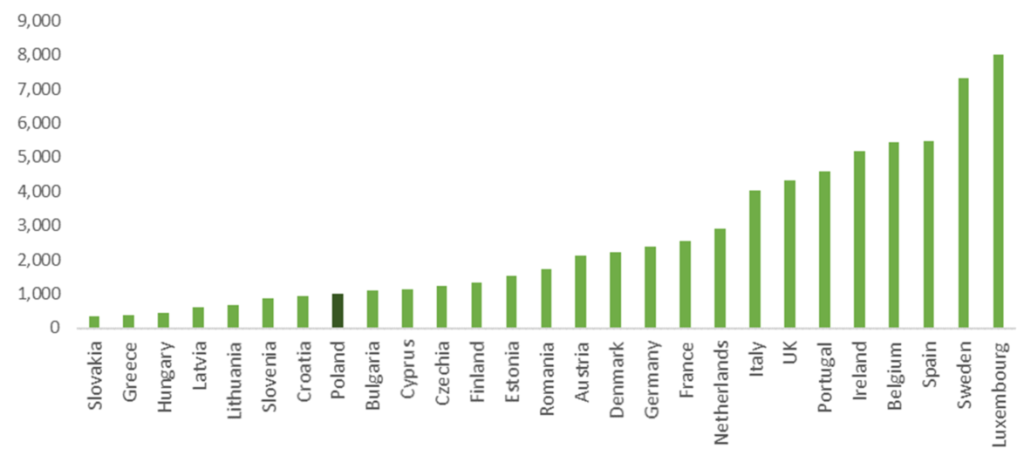

Strict lockdown in Poland was promptly introduced within two weeks of first confirmed cases. While there has been a huge variation in policy responses in Western Europe in terms of the speed and stringency of restrictions on people’s movement, business and other activities, the reaction of Visegrad countries followed the same pattern of strict restrictions implemented within 2-3 weeks since the first cases were reported.

Such actions were driven on the one hand by the experience of the hardest-hit countries like Italy and, on the other hand, by the fears that understaffed healthcare system in Poland could break down in case of massive breakout of COVID-19.

As a result of prompt state action, number of COVID-19 cases per 1 million people remained limited both in Poland and our regional peers (see Figure 3).

Figure 3: Confirmed COVID-19 cases per 1 million population (as of July 15, 2020)

Majority of restrictions in Poland was introduced in the second half of March:

- March 10, 2020 – the cancellation of mass events (over 1.000 participants outdoors or 500 indoors).

- March 14, 2020 – closure of schools (initially by March 25, later extended); prohibition of public gatherings; masses and funerals restricted to 50 people; closure of restaurants (take away and delivery allowed); closure of shopping malls, except for groceries and pharmacies (shops outside of malls were allowed to operate but with restrictions on the number of costumers); suspension of cultural institutions (theaters, cinemas, museums, etc.).

- March 15, 2020 – closure of international borders for ten days, later extended multiple times.

- March 24, 2020 – gatherings limited to two people (excluding families), except weddings, funerals and masses (up to 5 people), restrictions on “non-essential travel”.

- March 31, 2020 – closure of parks, boulevards, and beaches, as well as hairdressers, beauty, tattoo, and piercing salons; and closure of hotels.

The government has started to lift restrictions on April 20, 2020. The majority of them were lifted by May 30. For businesses, particularly relevant was the opening of shopping malls (May 4th), gastronomy (May 18th) and the international borders with EU member countries (June 13th).

However, schools remained closed and businesses that reopened had to apply new sanitary restrictions, like wearing masks and using hand sanitizers.

It seems that lockdown in Poland was successful in limiting the death toll. Putting aside controversies concerning methodology of counting COVID-19 deaths (Hirsch and Martuscelli 2020), no excess mortality in Poland has been recorded in April or May 2020 compared to the corresponding period of the previous year. In fact, there was even a slight decline in the number of deaths despite aging population.

However, the pandemic is not over yet and the next wave(s) might change that picture. Although lockdown and social distancing have allowed to avoid a spike in deaths so far, they took a heavy toll on the economy.

Economic Policy Response

The development of policy response took the Polish government more time than the introduction of lockdown. Government has started to work on its economic response (“anticrisis shield”) at the beginning of March 2020.

However, it took nearly a month to prepare it and pass it through Polish parliament. In subsequent weeks, the so-called anticrisis shield was modified several times, as well as supplemented by actions of the Poland’s central bank.

The economic policy response has been a mixture of budgetary programs, extra-budgetary measures, and actions by the central bank and regulators in Poland. They can be grouped into three broad categories:

So-called anti-crisis shields – drafting of it started at the beginning of March 2020; however, it took until March 31 before it passed through parliament. The main instruments were tax holidays, workplace subsidies, and regulatory adjustments (mainly to delay certain new regulatory and tax burdens). Since March 2020, the anti-crisis shield has been modified several times.

So called financial shield and anti-COVID-19 fund – as economic disruptions escalated and the initial anti-crisis shield felt short of expectations, the Polish government on April 8, 2020 announced additional program to subsidize companies that run within the Polish Development Fund (Polski Fundusz Rozwoju – PFR). PFR will also manage the anti-COVID-19 fund, which will be used to finance selected public expenditures outside of existing fiscal rules.

Actions by National Bank of Poland (NBP) and Financial Stability Committee Komitet Stabilności Finansowej – KSF) – along with governmental actions, the National Bank of Poland has lowered interest rates three times and announced an asset purchase program, while Financial Stability Committee1 lowered capital requirements for banks to keep credit flowing.

The anti-crisis shield is a broad umbrella for multiple evolving and overlapping support instruments for companies. Instruments included in the shield have been changing and vary significantly in terms of promptness and efficiency. The Polish government estimated at the end of April 2020 in Convergence Program that the overall cost of the program will amount to 3.2% GDP.

Among the most important are:

- standstill benefit for persons working under civil law contracts and self-employed persons – with a large scope of non-standard working agreements, many workers immediately lost their income and were not entitled to unemployment benefit. The cost of the program was expected to amount to 0.7% GDP, but until the beginning of July 2020, costs were around 0.2% GDP; however, this benefit goes in hand with EUR 1250 loan for microenterprises, that great majority of the companies will not have to pay back. The cost of loan scheme is around 0.4% GDP which taken together gives amount similar to initial governmental plans.

- 3-month exemption from social security contributions applicable to micro-firms (up to 9 insured people) and self-employed who do not insure anyone except themselves (subject to revenue condition); later it was broadened to partially include small firms (10-49 insured people), for which the exemption is capped at 50% of social security contributions. An exemption was introduced swiftly, but the instrument is costly (according to governmental estimates it will cost 0.65% GDP, but till the end of July costs exceeded 0,75% GDP) and poorly targeted: even micro-firms not affected by COVID-19 have benefited from the exemption, while larger companies in sectors heavily affected by pandemic were still obliged to pay the full cost of contributions.

- cofinancing part of employees’ salaries for companies– there are two, slightly different schemes of cofinancing of workplaces, both conditional on the significant fall in companies’ revenue. The first problem is that there are two programs addressing the same issue, and the second problem is the bureaucratic approach to applications. The jury is still out how many companies have applied and how swift were administration decisions – according to information from the beginning of July 2.8 million workers were covered by the program (out of 10 million working in non-financial corporations. The cofinancing was capped at 40% of average wage (PLN 2453 or EUR 550, including social security contributions) in the more generous scheme. The Polish government estimates that the overall cost of the program will amount to 0.5%—0.6% GDP, which is in line with figures reported by the end of June.

- support to the Polish healthcare system in the measures related to a epidemic – 0.3% GDP

- additional capital to Polish Development Fund – 0.2% GDP

- additional care allowance for carers of children aged 8 or less – 0.2% GDP.

The financial shield was announced on April 8, 2020, to speed up support for companies. With worsening business confidence and complicated procedures for larger companies applying for instruments from anticrisis shield government announced an additional program of financial shield run by Polish Development Fund (PFR).

Microenterprises, SMEs and large enterprises can receive up to PLN 100 billion (4.5% GDP) in subsidies, of which about PLN 60 billion (2.7%) may be retained by the enterprises as a non-refundable grant under the condition that they continue to operate after the support has been granted and jobs are preserved.

The program is much simpler than anticrisis shield and runs in cooperation with banks, which allowed prompt transfers to companies; the biggest weakness of the program is that support is conditional on the fall of revenue in just one month, enabling some unaffected companies to apply for support just by shifting part of the payments.

However, the promptness of the program is its huge advantage. Running program by PFR, however, raises other doubts about it financing – instead of receiving a direct transfer from budget PFR issued bonds that are only guaranteed by the Polish government, thus allowing the government to treat it as an off-balance item.

A similar construct was applied to an anti-COVID-19 fund of similar size to financial shield. In the initial version from the first anti-crisis shield the fund was meant as another budgetary fund created to support investment and recovery after the pandemic.

Later, however, it was moved into PFR so that its expenditure and debt issued to finance it would not be covered by domestic fiscal rules. Also, the aim of the fund was broadened and now it seems that it will be used as a “shadow budget”, allowing different Ministries to fund projects that are over the standard budget. Eurostat most probably will treat both financial shields an anti-COVID-19 fund as part of the general government.

The National Bank of Poland (NBP), besides lowering interest rate, launched a bond purchase program. The first cut of reference rate from 1.5% to 1% was announced on March 18, 2020 and was followed by an additional cut to 0.5% on April 9, 2020, and to 0.1% on May 28, 2020.

Besides lowering reference rate, NBP also cut the reserve requirement for banks from 3.5% to 0.5% starting April 30, 2020, while Financial Stability Committee (KSF) recommended waiving the systemic risk buffer (% of a given bank’s total risk exposure) which was approved by Polish Ministry of Finance.

The most controversial part of the COVID-19 policy response has been governmental bond purchases on the secondary market by NBP that started in March. NBP claims that operations are aimed at supplying liquidity and stabilization of long-term interest rates.

Still, in reality, such actions breach the prohibition of financing of public debt by NBP that is written in the Polish constitution.

Limiting operations to the secondary market does not change much, as large share of lately issued government bonds were bought by state-owned banks that later sold them to NBP. Besides buying governmental bonds, NBP also announced that it would buy bonds guaranteed by government, which in practical terms allows purchases of PFR bonds, thus providing financing for financial shield and anti-COVID-19 fund.

State of the Polish Companies Over Time

Initial macroeconomic data indicate that COVID-19 had the strongest impact in April 2020. COVID-19 had an impact on the Polish economy through two channels – official restrictions that limited business activity and consumer reactions, as many consumers changed their behavior irrespective of formal regulation, just to limit the risk of contracting COVID-19.

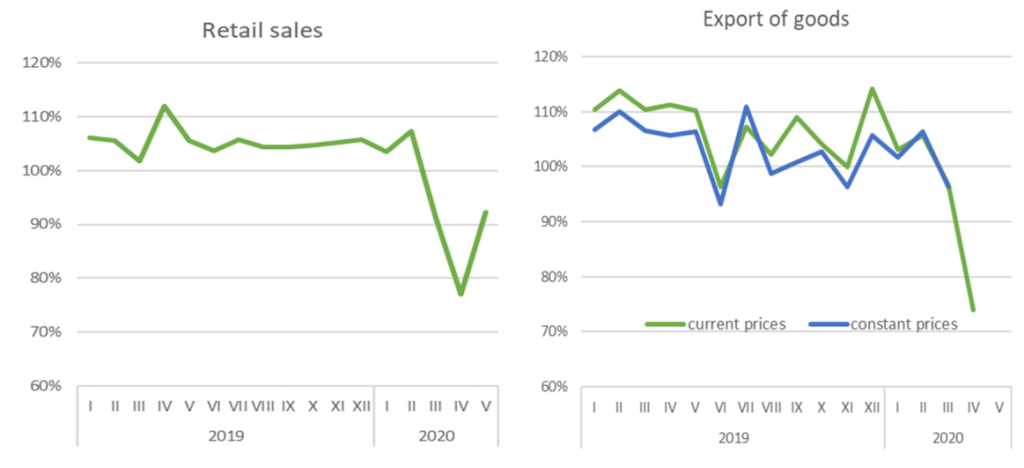

Unfortunately, in Poland, official statistics are reported with a significant lag, but we can see already that in line with the heaviest restrictions, both domestic sales and export experienced a significant fall (over 20%) in April 2020 (see Figure 4). In the case of retail sales before the fall in March and April 2020, increased sales in February 2020 can be observed as households stocked themselves before lockdown.

Although May figures are not available for export yet, in the case of retail sales, a strong rebound can be observed, as the restrictions were gradually lifted, and people also felt safer. Nevertheless, sales in May this year were below the level of May 2019.

Figure 4: Retail sales and export of goods (change from corresponding period of previous year)

Source: Statistics Poland (2020a, 2020b).

Source: Statistics Poland (2020a, 2020b).

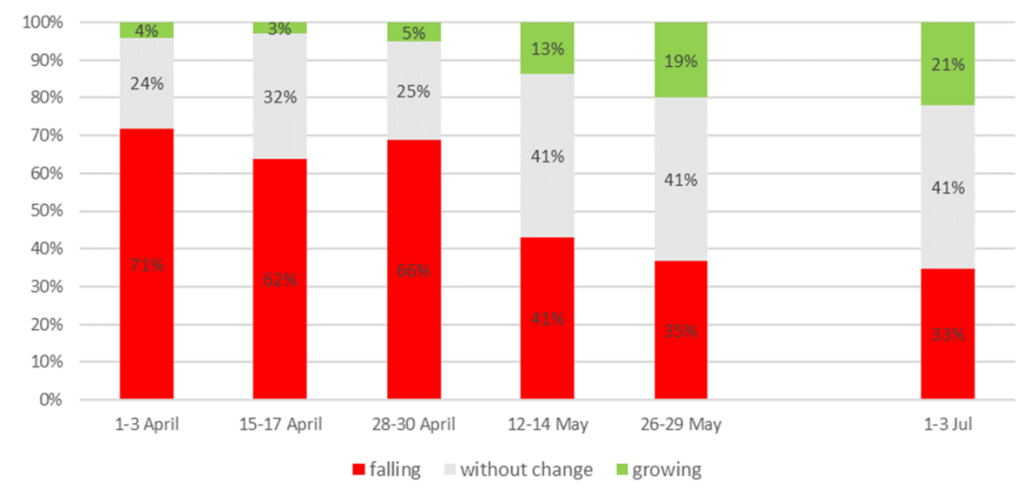

Company–level data for Poland indicate that the impact of COVID-19 was the strongest in April 2020. Rapidly changing situation and huge lags in official statistics prompt many organizations to conduct surveys to gauge developments in the Polish economy.

To follow how the impact of COVID-19 changed over time, surveys conducted by the Polish Economic Institute (PIE), governmental economic think tank, are particularly informative. Most importantly, PIE (2020) conducted seven surveys, initially in 2-week intervals asking companies in Poland about their financial situation and plans.

While most companies reported a falling number of orders during the entire April 2020, the share of them was the highest at the beginning of the same month (see Figure 5).

Figure 5: Change of orders (% of companies reporting fall/no change/growth of orders)

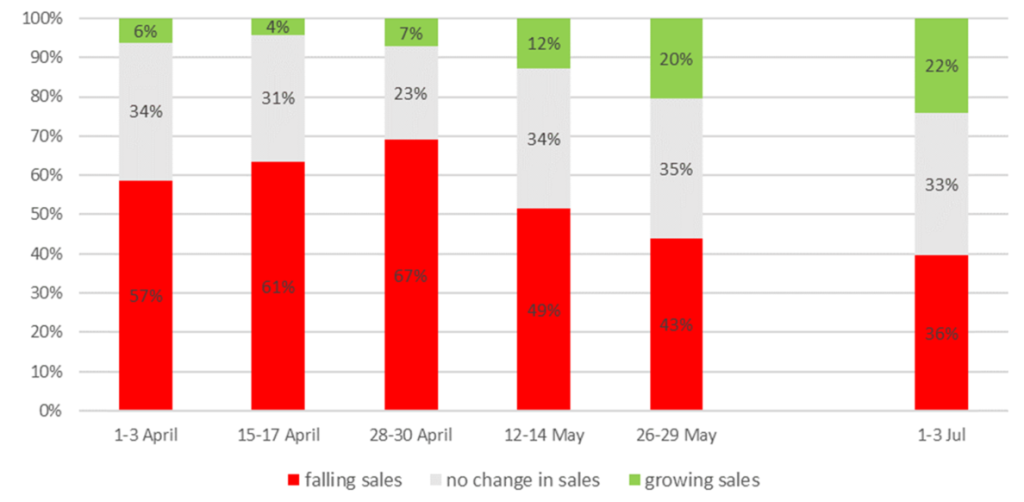

As far as current sales are concerned, the biggest drop was observed at the end of April 2020, when over 2/3 of companies were reporting it (see Figure 6).

Figure 6: Change of sales (% of companies reporting fall/no change/growth of sales)

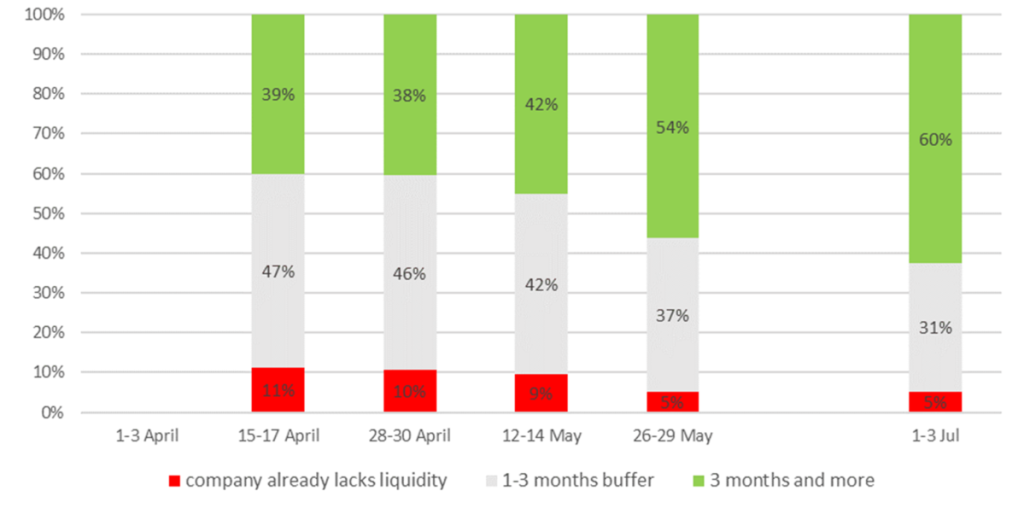

With falling sales, liquidity became an issue. In April 2020, around 10% of companies in Poland struggled to retain liquidity while further 50% of companies declared that their cash buffers would not last for more than three months (see Figure 7).

Figure 7: Liquidity buffers (% of companies reporting cash buffers sufficient for more than 3 months, 1-3 months or already facing liquidity problems)

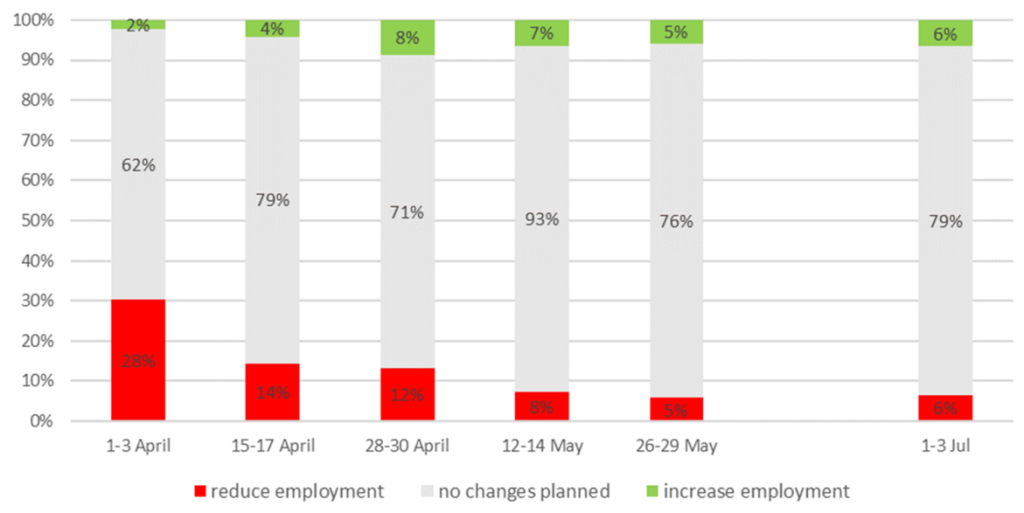

Initially, nearly 30% of companies in Poland considered laying people off. However, by the end of April this percentage had fallen to 22% (see Figure 8).

Figure 8: Employment change (% of companies planning reduction/no changes/increase of employment)

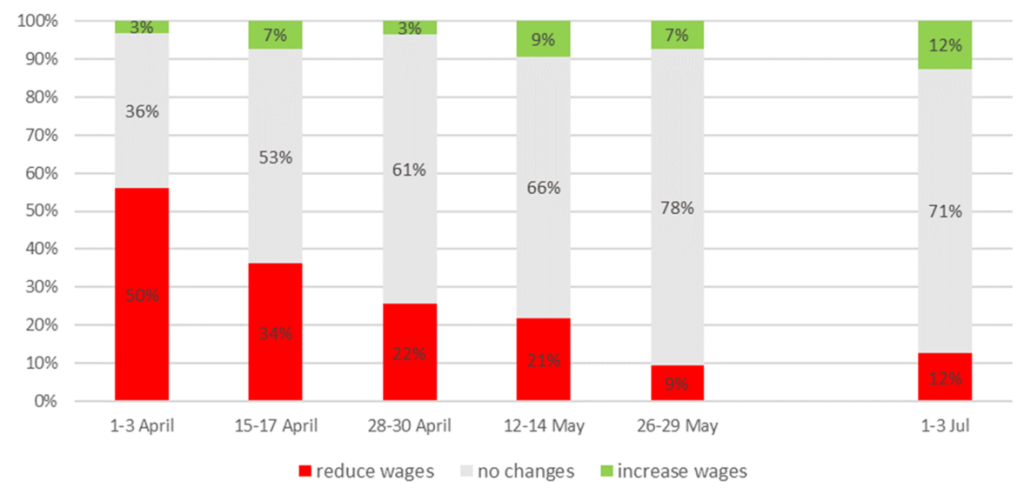

During the same time, the percentage of companies declaring wage cuts went down from 50% at the beginning of April 2020 to 22% at the end of the same month (see Figure 9).

Figure 9: Wage change (% of companies planning reduction/no changes/increase of wages)

In the last wave of the survey (beginning of July 2020), more than 1/3 of companies reported sales to still be lower than a year ago (see Figure 6). However, the percentage of companies with liquidity problems felt to 5% (see Figure 7).

Simultaneously, the percentage of companies planning wage cuts felt to 12% (see Figure 9) and only 6% are planning layoffs (see Figure 8), indicating that most companies that stayed in business do not expect further downsizing.

To explain the changing state for companies in Poland in the next section, the paper first discusses the main problems reported by them and later discusses to which extent they were addressed by government response to the COVID-19 crisis.

Main Problems for Companies in Poland During the COVID-19 Pandemic

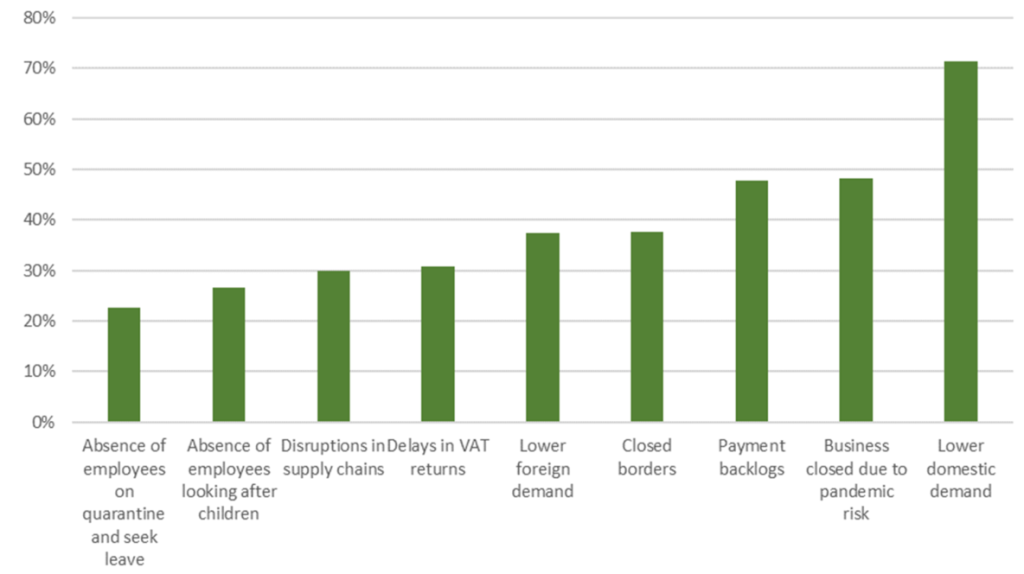

In the most challenging month of April 2020, companies reported several problems (see Figure 10). To explore issues facing companies from particular sectors of the economy paper uses a survey by Centrum Monitoringu Sytuacji Gospodarczej – CMSG (2020), a joint initiative of employer’s assassinations, Civil Development Forum (FOR), and Warsaw School of Economics (SGH).

The first wave of the survey was conducted in the first half of April 2020, at the peak of the lockdown in Poland and a moment of the highest uncertainty for its business community.

Overall, the biggest obstacle facing companies was lower domestic demand, followed by administrative orders to desist from trading for retail and commercial businesses, apart from those providing essential services.

Importantly, in the third position of challenges were payment backlogs. The non-availability of employees due to quarantine was among the lowest concerns for the businesses. Such order of worries might suggest that the direct consequences of pandemic (people getting ill by it) had an only minor impact on business.

Much more significant was that people in order not to get ill stayed confined to their homes, lowering demand, and administrative actions, explicitly temporarily closing many businesses. The jury is still out on the main driver of the contraction in demand – administrative closures or voluntary reactions of customers that to minimalize human contact avoided businesses that were legally permitted to operate.

Obviously, for businesses closed by law, the first factor was decisive, but for the economy, as whole customer reactions might have been even more important. Primary evidence from the US indicates that consumer reactions have been a key, as differences in the timing of the opening of the economy in neighboring states led to no visible impact on the consumption dynamics (see Chetty et al. 2020).

It is also worth noting that among high-uncertainty companies started to hoard cash and stop paying their suppliers, generating payment backlogs.

Figure 10: Challenges facing companies in the first half of April 2020 (% of companies reporting given item as a serious obstacle)

Along with weaker domestic demand, which was the biggest challenge reported by Polish companies in most sectors, the relative importance of other problems differed.

The second biggest problem for construction companies was payment backlogs, which are unfortunately common in this sector and were further exuberated by delays in VAT returns. Their fourth biggest problem was caused by disruption in supply chains.

It is worth noting that none of the major problems (maybe with the exception of closed international borders that to some degree might also disrupt supply chains) of the sector was caused by the administrative closures that were designed to limit the spread of the COVID-19 virus.

Payment backlogs were a second major problem for manufacturing companies, just after weaker domestic demand. Not surprisingly, among all the sectors, manufacturing was most affected by weaker external demand. Poland is integrated with global value chains, and economic struggles of other countries are directly felt by the most important export sector in Poland – manufacturing.

Transport and logistics companies were directly affected by administrative restrictions. As transport companies offer their services primarily to other companies, payment backlogs became a severe issue. Beside those two problems, these companies also pointed to troubles caused by closed international borders and VAT settlements.

A broad category of companies providing business services (consultancy, IT, professional education, etc.) was among the least affected by the COVID-19 crisis. Furthermore, such services were one of two sectors where lower demand was not the most important issue. Instead, their main problem was payment backlogs.

Retail and wholesale companies beside payment backlogs reported problems with many employees staying at home to look after their children. Among all the sectors, this problem was most visible in retail and wholesale.

Companies operating in tourism, gastronomy, and hospitality were directly affected by administrative closures – the harms caused by closures were nearly as often reported as lower demand. Furthermore, compared to other sectors for tourism and related activities, closed borders were a serious issue.

The personal services sector was most affected by administrative restrictions – for hairdressers and beauticians, closure of business was a bigger obstacle than lower demand.

Also, companies providing healthcare were affected by administrative restrictions. However, in their case, lower demand was the key issue. Beside those two problems, companies also reported problems with the acquisition of supplies.

Companies providing financial services beside lower demand reported increasing problems with late payments.

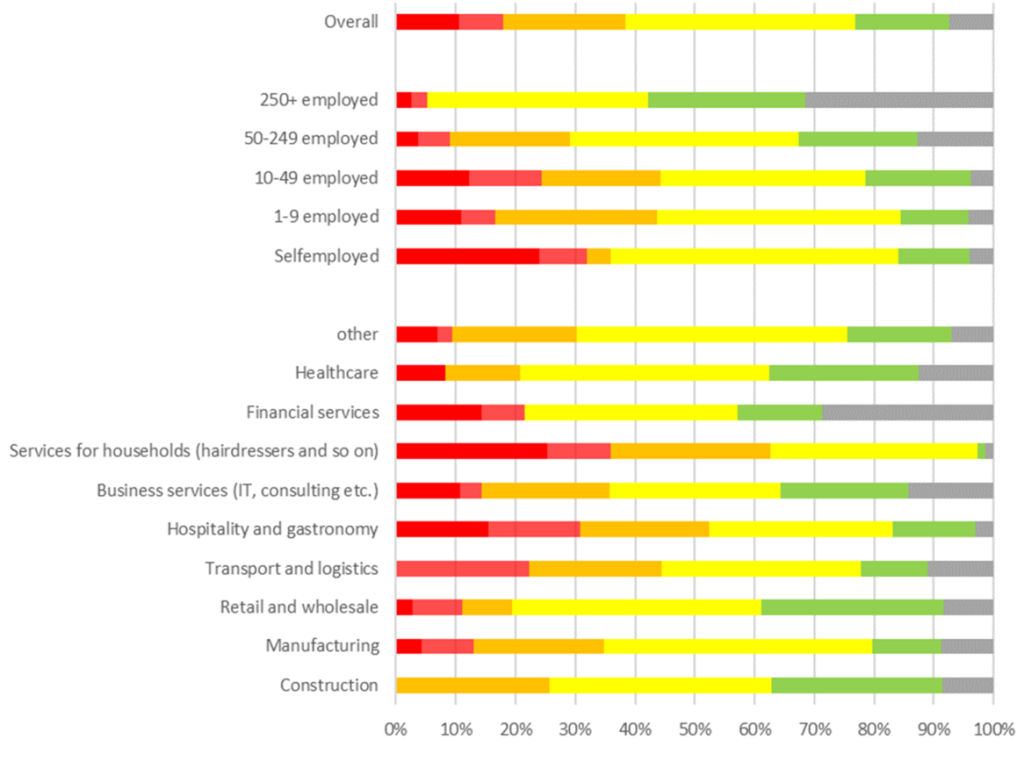

Fall in domestic demand was an expected result of lockdown, but it affected the liquidity of companies. Encouraging people to stay at home meant that they would purchase fewer goods and services.

Putting aside administrative restrictions, it would be hard to expect that people will be as eager as before to attend theaters, cinemas, or fairs and risk contracting the COVID-19 virus. Falling sales led to problems with liquidity, but the scale of the problem varied between sectors.

Overall, the most resilient were the largest companies of 250 employees or more (see Figure 11). More than 50% of them had liquidity buffers for three months or more, while for smaller companies the liquidity issues were a bigger problem.

In terms of sectors, most problems were reported by companies providing services for households, hospitality, and gastronomy, which were sectors most directly affected by lockdown and changed behavior of cautious consumers.

Figure 11: Liquidity problems (% of companies)

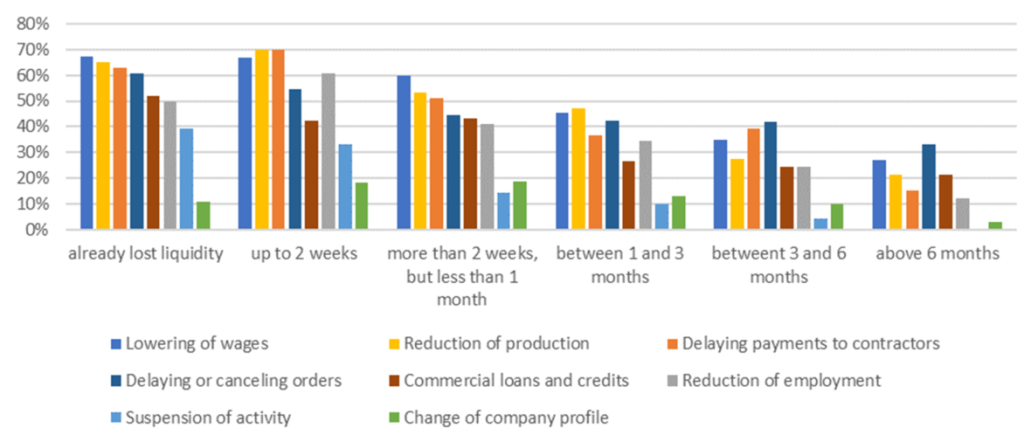

The liquidity problems of companies created a threat of negative spillovers. With falling demand, companies had to adjust their operations. Assuming that impact of the COVID-19 virus is temporary, two actions declared by companies having liquidity problems were particularly worrying: delaying payments to contractors and layoffs (see Figure 12).

Delaying payments to contractors created a risk that problems will be passed from one company to another, increasing uncertainty, and breaking down intercompany linkages. Layoffs had a similar effect, reducing household confidence and purchases.

Of course, layoffs should be avoided only under the assumption that COVID-19 is a temporary problem.

Figure 12. The liquidity position and actions taken or considered in the light of COVID-19 (% of companies)

The Efficiency of Policy Response to Combat the Spread of the COVID-19 Virus

Support packages and lifting of the restrictions improved situation of companies. As already mentioned, the percentage of companies reporting significant liquidity problems and planning layoffs felt considerably by July 2020.

Although the PIE survey is designed to be representative, it should be noticed however that part of the effect might be a result of the weakest companies going out of the market. However, available data about business registrations and closures suggest that such effects most probably were very limited.

Enormous fiscal costs raise questions about the efficiency of the used state measures. It is too early to sum up overall fiscal costs, but at the moment, the price tag at the anticrisis shield and financial shield stands well above 5% GDP.

Taken together with a large initial structural deficit (above 2% GDP) and fall of revenue (at least 2% GDP) general government deficit this year most probably will be above 10% of GDP. Considering indexation rules of multiple expenditure items and expected only limited rebound of revenue, most probably large deficits will constitute a policy challenge past year 2020.

Considering probable problems of public finances’ poor targeting of policy responses is an issue. As indicated by George Mankiw, setting a priori criteria for the help would be challenging (Mankiw 2020). FOR proposed more money-wise approach – grant support to each individual and company that requests it, but as a loan, that ex-post could be conditionally converted into a grant.

The conversion would depend on the change in revenue during the whole year 2020 compared to year 2019, so households and companies most affected would not have paid it back. Taking the whole year as a reference point would make shifting revenue much harder, ensuring that help would go to the most affected entities. For the rest of the companies, the help would be just liquidity support, which also should help them pass through the most challenging moment.

To some extent, government introduced this approach in a financial shield in Poland, but the previous anticrisis shield was less targeted.

It is too early to assess the overall efficiency of the support. As mentioned at the company level, results are rather good, but it comes at a too high fiscal cost. The overall macroeconomic impact is still debatable. As discussed in the first part of the paper, the Polish economy had several strengths that limited the impact of the COVID-19 shock.

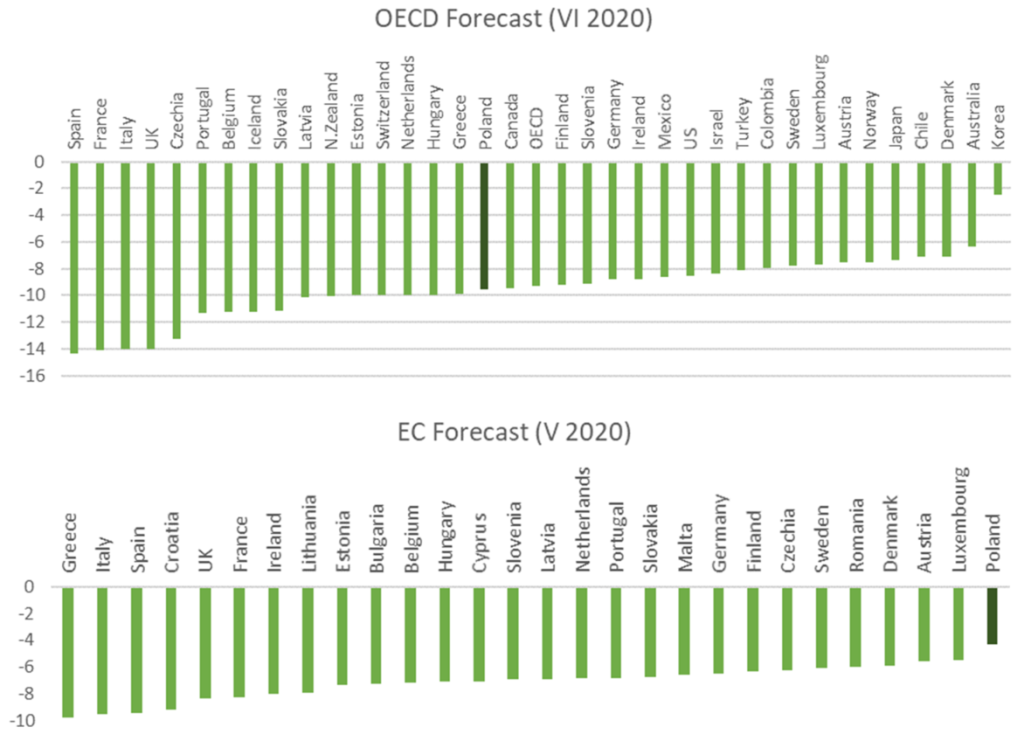

According to the Summer 2020 Economic Forecast prepared by European Commission EC (2020) the fall of GDP in Poland in 2020 will be the smallest in the EU (see Figure 13).

However, it should be taken into account that before the COVID-19 crisis growth forecasts for Poland were also among the highest in the EU, so the forecasted relatively good performance is not only a result of policy response but also a favorable starting position.

Furthermore, all current forecasts are of limited reliability, as the circumstances are extraordinary. So, it is worth to mention that contrary to the European Commission, OECD is less optimistic, forecasting that several OECD member countries will weather COVID-19 better than Poland (see Figure 13).

Figure 13: GDP growth forecasts for 2020

Source: OECD (2020) and EC (2020).

Source: OECD (2020) and EC (2020).

Conclusion

This paper presents how the COVID-19 virus and subsequent policy responses by the Polish government affected companies in Poland. Although the number of COVID-19 cases in Poland has been rather limited, policy actions aimed at limiting the spread of the virus and general uncertainty heavily affected business confidence.

The most severe problems were reported by companies in April, at the heist of the lockdown. The subsequent gradual lifting of lockdown and restrictions on business, coupled with generous support programs resulted in improved business confidence as the economy has slowly rebounded.

While the economic policy responses seem to help companies now, they were poorly addressed, which inflated their costs. It is too early to evaluate the efficiency of programs from a macroeconomic perspective, as GDP data are not available yet, and the dispersion in economic forecasts is vast.

Sources

Chetty, R., J. Friedman, N. Hendren, and M. Stepner (2020). How did covid-19 and stabilization policies affect spending and employment? a new real-time economic tracker based on private sector data. Working paper, Opportunity Insights.

CMSG (2020). Badanie „sytuacja ekonomiczna przedsiębiorstw w czasach koronawirusa” – kwiecień 2020 r. (Survey of economic conditions of enterprises in April 2020). Available at: https://pracodawcyrp.pl/cmsgrp/sytuacja-ekonomiczna-przedsiebiorstw-w-czasach-koronawirusa-kwiecien-2020-r

FOR (forthcoming). Doganiając Zachód (Catching up with West).

Hale, Thomas, Sam Webster, Anna Petherick, Toby Phillips, and Beatriz Kira (2020). Oxford COVID-19 Government Response Tracker, Blavatnik School of Government. Available at https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker

Hirsch C. and Martuscelii C. (2020). The challenge of counting COVID-19 deaths, Identifying ‘excess deaths’ is one way to grasp the pandemic’s true impact. Available at https://www.politico.eu/article/coronavirus-the-challenge-of-counting-covid-19-deaths/

Mankiw G. (2020). A Proposal for Social Insurance During the Pandemic. Available at: https://gregmankiw.blogspot.com/2020/03/a-proposal-for-social-insurance-during.html

OECD (2020). Tourism Policy Responses to the coronavirus. Available at https://www.oecd.org/coronavirus/policy-responses/tourism-policy-responses-to-the-coronavirus-covid-19-6466aa20/

PIE (2020). Ponad ¾ polskich pracowników nie boi się utraty pracy, a 60 proc. Firm ma zapasy finansowe na ponad 3 miesiące (Over ¾ of Polish workers are not afraid of losing job and 60% of companies has liquidity buffers for over 3 months). Available at: https://pie.net.pl/ponad-%c2%be-polskich-pracownikow-nie-boi-sie-utraty-pracy-a-60-proc-firm-ma-zapasy-finansowe-na-ponad-3-miesiace/

Statistics Poland (2020a). Retail sales index – May 2020. Available at https://stat.gov.pl/en/topics/prices-trade/trade/retail-sales-index-may-2020,11,29.html

Statistics Poland (2020b). Foreign trade turnover of goods in total and by countries in January-April 2020. Available at https://stat.gov.pl/en/topics/prices-trade/trade/foreign-trade-turnover-of-goods-in-total-and-by-countries-in-january-april-2020,1,96.html

The Financial Stability Committee comprises four main financial safety net institutions, i.e. National Bank of Poland, the Financial Supervision Authority, the Ministry of Finance, and the Bank Guarantee Fund

The article was originally published in The Visio Journal No. 5 “The Economics of a Pandemic: The Case of COVID-19”.

Continue exploring:

DisinforNation: Disinformation Practices in CEE: 4liberty.eu Review No. 13 Now Available Online