It is settled that provisional application of Deep and Comprehensive Free Trade Area (DCFTA) between Ukraine and the EU will start since January 1, 2016. In a response, Russia is expected to increase trade barriers vis-à-vis Ukrainian goods. The decision to launch additional protectionist measures was announced by Dmitry Medvedev, the Prime-Minister of the Russian Federation.2

In 2014-2015 the Russian Government passed several decrees that envisage establishment of MFN tariffs and quantitative restrictions in trade with Ukraine as soon as Ukraine will start implementation of the DCFTA. We are referring to two decrees:

-

Decree #959 dated 19.09.2014 envisaging unilateral introduction of the MFN duties on about a quarter of Ukraine’s trade nomenclature currently exported to Russia;

-

Decree #842 dated 13.08.2015 adding Ukraine to the list of countries, against which Russia applies trade sanctions and, thus, imposes embargo on selected Ukrainian agro-food products.

The question is about severity of the impact of these measures on the Ukrainian economy. Our analysis shows that the impact could be surprisingly low.

To start with, increased protectionism is not a new direction of Russian trade policy regarding Ukraine. Russia has already implemented a number of measures limiting imports. In particular, Ukraine has filed multiple specific trade concerns in the WTO regarding growing number of Russian import bans referred to TBT and SPS issues. As of now, import bans include railcars, confectionery, dairy products, alcohol products, vegetables, soya beans, sunflower seeds, poultry etc. Also, Ukrainian companies have got problems with access to public procurements and with customs procedures. So, producers are aware about potential threats and should have already adjusted their production and external sales plans accordingly.

To start with, increased protectionism is not a new direction of Russian trade policy regarding Ukraine. Russia has already implemented a number of measures limiting imports. In particular, Ukraine has filed multiple specific trade concerns in the WTO regarding growing number of Russian import bans referred to TBT and SPS issues. As of now, import bans include railcars, confectionery, dairy products, alcohol products, vegetables, soya beans, sunflower seeds, poultry etc. Also, Ukrainian companies have got problems with access to public procurements and with customs procedures. So, producers are aware about potential threats and should have already adjusted their production and external sales plans accordingly.

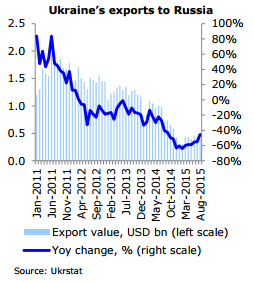

Exports to Russia have already sharply contracted. During second half of 2014 – first half of 2015 Ukraine’s exports to Russia amounted USD 6.4 bn, which is only 36% of 2012 value. As a result, the Russian market became less important for Ukraine: in 2012 Russia accounted for 25.6% of Ukraine’s exports of goods, whereas in second half of 2014 – first half of 2015 the share decreased to 14.6%. Thus, further contraction of trade with Russia will be less visible in overall exports than it could be few years ago.

Partial equilibrium analysis of trade policy shocks sheds light on the effect of potential policy measures by Russia. The analysis was focused on tariffs and quantitative restrictions, while non-tariff barriers were not taken into account. We used trade statistics for second half of 2014 – first half of 2015 and compared different scenarios of increase in trade barriers by Russia.

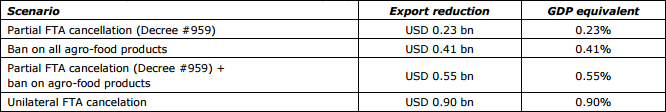

The analysis showed that the implementation of Decree #959 and agro-food products ban will have rather moderate impact on exports to Russia if compared to current trade drop. To be more specific, application of Decree #959, which impose MFN duties for a number of Ukrainian goods, could potentially decrease exports to Russia by USD 0.23 bn or 3.6% (0.23% GDP). Ceteris paribus, pure effect of import ban on all agro-food products could lower Ukraine’s exports to Russia by USD 0.41 bn or 6.4% (0.41% GDP). Finally, joint application of both measures could lead to contraction of Ukraine’s exports to Russia by USD 0.55 bn or 8.6% (0.55% GDP). For comparison, in second half of 2014 – first half of 2015 the export to Russia dropped by USD 6.8 bn or 6.6% GDP.

Table 1. Evaluation of possible scenarios for Russian trade policy vis-à-vis Ukraine

Source: Giucci R., Ryzhenkov M., Movchan V., (2015) Cancelation of FTA between Ukraine and Russia? Estimation of impact on Ukrainian exports. German Advisory Group in cooperation with the IER Kyiv, Policy Briefing Series. PB/11/2015

Moreover, even unilateral cancellation of entire FTA by Russia would have rather moderate direct impact. Ukraine could lose about USD 0.90 bn of exports or 0.90% GDP. The severity of impact of Russian trade measures has vanished with reduction in export dependency on Russian market. Same calculations based on data from 2012, when Ukraine exported USD 17.6 bn to Russia, showed potential impact of unilateral FTA cancellation equal to USD 3.0 bn.

What is a potential for reallocation of lost sales from Russian to other markets? We looked at exports of top-20 product categories (at 4-digit HS), which Ukraine sold to Russia in the first half of 2014, and compared with trade statistics for the same period of 2015. Results show that for many product categories trade tensions resulted in loss of the Russian market, but no significant alternatives were found. The best prospects for reallocation from Russian market were demonstrated by metallurgy, with many sales reallocated to the US, the EU and Asia. Partial reallocation was observed for machines, food and paper products. Exports of rail cars and chemicals, almost fully dependent on Russian market, did not demonstrate any significant reallocation to other external markets.

To conclude, trade barriers that Russia is expected to introduce in response to the DCFTA application will have moderate impact on Ukraine’s exports. Moreover, these measures will be a continuation of current Russia’s trade policy regarding Ukraine, and, thus, they have been long anticipated by businesses that should have taken into account this risk into their trade strategies. Still, some time will be required to reallocate sales from the Russian market to the rest of the world.

The article was originally published on November 11, 2015 as a Highlight of the Month in the Issue #11 (181) of Monthly Economic Monitor of Ukraine (http://www.ier.com.ua/en/publications/regular_products/monthly_economic_monitoring?pid=5065)

1 The article is based on Giucci R., Ryzhenkov M., Movchan V., (2015) Cancelation of FTA between Ukraine and Russia? Estimation of impact on Ukrainian exports. GAG/IER, Policy Briefing Series. PB/11/2015, http://www.beratergruppe-ukraine.de/wordpress/wp-content/uploads/2014/06/PB_11_2015_en.pdf