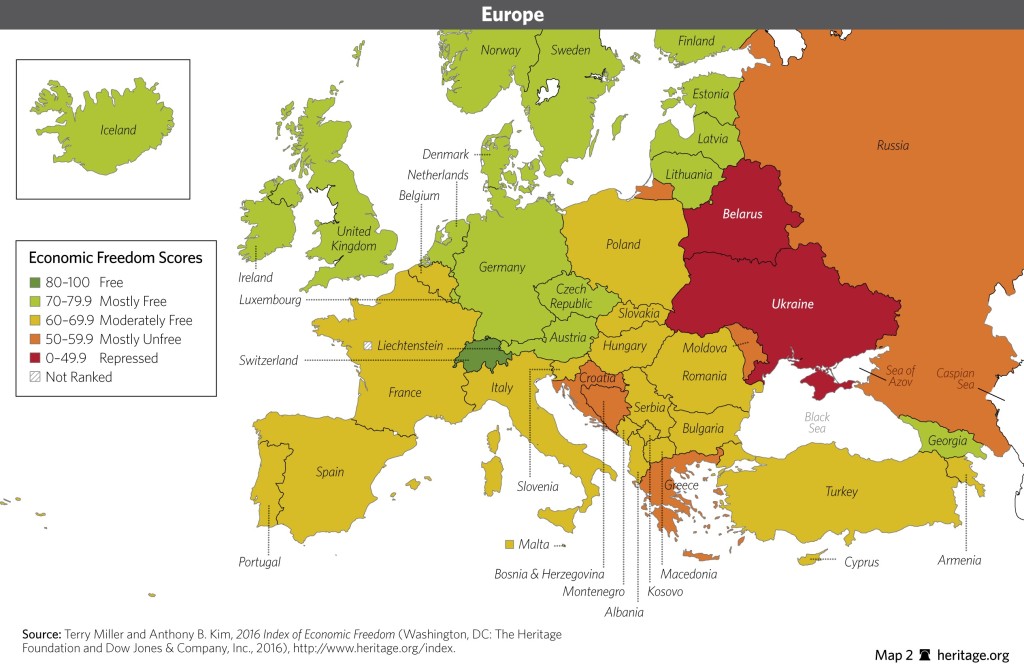

Tax Burden and Policy in Georgia

BY

New Economic School Georgia / August 30, 2024

The tax burden directly determines how many resources remain in the hands of businesses and how much goes to the state budget. However, it also has some influence on the price level. The size of the tax burden affects the speed of economic development - the more money a business has in possession, the more development and expansion opportunities it has, the more materials it buys, the more money it invests in the purchase of new equipment.