Unlimited purchases of ECB bonds? New dollars from FED? Maybe… Greece wants more time. Time is money.

A bit of tension was brought into the holiday boredom by the rumor brought by the German magazine Der Spiegel saying that ECB is preparing plans to introduce interest rate ceilings on sovereign bonds of the PIIGS countries. This would have a form of unlimited purchases of these bonds by the central bank. Since such redistribution of loss resulting from the stupid policies within the Eurozone would bring a pile of freshly printed euro to the market, the markets are all in for this action. Such information was denied by ECB itself, according to the Bank it is “absolutely misleading to report on decisions which have not yet been taken and also on individual views, which have not yet been discussed by the ECB’s governing council”. Additionally, Angela Merkel reportedly supported the refusal of the German Bundesbank to use ECB to intervene on the bond markets, which seems to be a big obstacle since this lady controls the European wallet today.

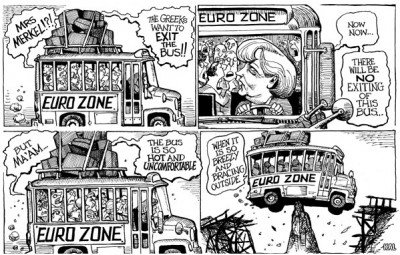

Do markets want another flood of new money? (The right answer is in the upper picture).

Do markets want another flood of new money? (The right answer is in the upper picture).

A bit more realistic promise of a new portion of the drug of freshly printed money for helpless markets was provided by the American FED. Publication of the minutes from the FED meeting at the beginning of August revealed a discussion about possible monetary stimulant in case of insufficient recovery of the American economy.

Negotiations were held between EU officials and government’s representatives were held in Greece. At the following press conference the head of the Eurogroup J.C. Juncker warned that it is the „last chance“ to carry out the reforms and implement austerity measures. Another decision concerning program of aid will be made in October, after Troika publishes its report about this country. Greece will probably ask for extending the plan of financial consolidation for another two years. These two years came from a macromodel of the Greek Ministry of Finance. Two-year delay is allegedly going to guarantee that recovery will be more dynamic and situation with debt more sustainable. Who would believe in macromodels, especially the Greek ones? It seems that the German Minister of Finance does not. Wolfgang Schaeuble doesn’t think that „giving more time is a solution“. According to him „more time… means more money“ and „there are limits“. Greek Prime Minister Samaras assures that „Germans will get their money back – I personally guarantee that! Everyone else as well. We will fulfill our obligations.“ Now we finally feel relieved!

There are also some positive news coming from Greece. And I don’t mean the plans to sell unpopulated Greek islands. Here you can find quite snippy article about what this country managed to achieve during the last couple of years in savings and consolidation of public finances. It calls for Europe not to surrender to the temptation to turn this country into exemplary case of scapegoat and not to kick it out of the monetary union using pseudo-moralizing arguments. Several signs indicate that Europe is indeed considering Grexit.

Whatever the plans of the European leaders concerning Greece are, it is a fact that paradoxically good news about a significant reduction in the primary deficit of the country (public revenues minus public expenditure without interest spending on the state debt) radically increases the possibility of intentional default on their debt, which is held mainly by us, European taxpayers. Should Greeks borrow more so that they could pay us?

After the PIIGS countries applied similar measures, also Belgium, Denmark, and Slovakia is reportedly planning to introduce limits on cash transactions. This limit is supposed to be EUR5000. Apart from the fact that it is excessive interference with economic freedom and privacy of the citizens, it is interesting to see how governments force citizens to move their money to the (on European level) fragile and partly insolvent banking sector. Not only do we subsidize their existence out of our taxes through various aid programs, through artificially low interest rates of the central bank, but we will also be forced to use these institutions in transactions. Unfortunately the state and banks sleep in one bed.

At the end an inspiring suggestion for the holiday weekend with wine. How to spend EUR 107 thousands in a restaurant.

Have a rich weekend! Juraj Karpiš