The world perceives Ukraine as a country where political, large-scale and small (petty) corruption have become a natural component of social relationships. At the same time, a consensus has emerged that it will be impossible for Ukraine to be successful without eradicating widespread corruption. Fighting corruption is a complex and multi-dimensional process.

Hence, assessments of corruption scale, willingness to fight it (political will) and the efficiency of different types of anticorruption measures vary greatly. It should be noted, however, that it is the perception of corruption hat all currently known international ratings measure.

Economic estimates of corruption-caused losses and gains from fighting corruption are indeed rare. Measurement of corruption scale and adequate assessment of the efficiency of anticorruption actions are a challenge for experts, politicians, and society.

Traditionally, corruption is broken into three functional types, such as political corruption, large-scale (grande) corruption, and small-scale (petty) corruption. The IER analyzed measures aimed mainly to lower political corruption at the national level.

For the purpose of the analysis, a limited number of measures were chosen in the sectors where corruption was traditionally considered as Ukraine’s calling card, including gas market, tax administration, public procurement, banking system, and governance of state-owned enterprises.

Natural Gas Market

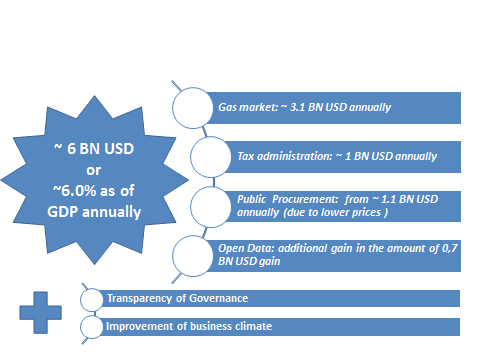

For many years, the natural gas market remained one of the most corrupt sectors of Ukraine’s economy. It is from this sector that oligarchs extracted rents. On the whole, the implemented measures made it possible to liquidate the government losses in the amount of approximately USD 3 bn per annum, and for the first time over the recent years PJSC Naftogaz Ukrainy (Naftogaz) has become profitable.

Yet, the gas sector reform process has not been completed yet, and going forward, the new rules will be tested for their anticorruption resilience.

Tax System

So-called «tax holes»1 have traditionally been one of the problems with Ukraine’s tax system. According to assessment performed by Ukraine’s Ministry for Revenues and Duties in 2014, the scope of so-called tax holes in 2013 amounted to more than UAH 300 bn, which resulted in a UAH 50 bn loss of revenues from the State Budget.

Based on the government estimates, the aggregated amount of tax holes over 2010-2013 reached UAH 600 bn. In 2014, Ukraine’s government announced the tax holes closure as one of its priorities.

The IER calculated that tax revenues resulting from liquidation of conversion platforms and fighting schematic tax credits amounted to approximately USD 3 bn.

Public Procurement

Public procurement has traditionally been one of the main areas of corruption at all levels of the state. As a result, the government has always incurred significant financial losses. According to the data of the State Security Service of Ukraine, annual losses from corrupt schemes implemented in the area of public procurement reached 10-15% (UAH 35-52.5 bn) of State Budget expenditures.

Introduction of the ProZorro system has contributed to lowering corruption in the procurement system and saving of funds as a result of the switch to market prices.

Data Access

Until recently access to most of state registers and other data collected and stored by state entities was monopolized by bureaucrats. Receiving many different types of information (including from the registers) required filing requests to state agencies. Access to data in most of the registers was closed to the public.

This facilitated shadow schemes for such data usage as well as created an environment conducive for corruption at different levels of public administration. The lack of transparency helped the corrupt officials hide their wrongdoings.

That is why the 2014-2017 Anticorruption Strategy established access to information as a priority area in corruption prevention activities. The open data portal was created and a vast number of state registers became open to public. Ukraine’s progress in open data transformed into higher ratings in the relevant international ratings. According to the Open Data Barometer study, Ukraine was ranked 17th in 2017 (44th in 2016 and 52nd in 2015).

Deregulation

Deregulation has become one of the government policy areas, which aims to reduce the corruption opportunities for bureaucrats. In the four years that followed the Revolution of Dignity and the change of political regime, Ukraine has moved 38 positions up in the World Bank’s Doing Business – from 112 in 2014 to 76 in 2018.

This sharp move was due to reduction of the number of mandatory licenses and permits, especially in the construction industry and due to simplified tax administration.

Banking System

Also, Ukraine has improved the supervision of the banking system, required disclosure of information on the ownership structure of banks, and introduced other measures reducing the corruption risks in the sector. A significant part of banks with opaque ownership structure and a large portfolio of related parties’ loans had been shut down before the NBU audits were finished. Out of 180 banks operating in Ukraine in early 2014, only 82 remained in the market in March 2018.

SOEs

Besides, there are reforms aimed at state-owned enterprises (according to some opinions, the most corrupt institutions in Ukraine). In the first nine months of 2017 only 1,611 companies were still in operation, with 1,056 being profitable.

The reforms aim to prevent political interference in the operations of SOEs, liquidate the respective corruption schemes, separate the function of regulator and owner and implement internationally acceptable corporate governance standards. Privatization of the SOEs is an important element of the reform. The small-scale privatization is already being carried out with the help of ProZorro sales system.

Overview of Anticorruption Measures

The preliminary findings of the analysis demonstrate that Ukraine has made significant progress in overcoming corruption through a radical change in the rules of the game in the public procurement and gas markets, improvement of tax administration and the introduction of public access to information. The total economic gain from anticorruption measures is preliminarily estimated at 6% of GDP, or USD 6 bn (see Figure 1).

Figure 1: Economic effect of anticorruption measures undertaken in 2015-2017

In the historic dimension, between 2014 and 2018, Ukraine made an unprecedented large number of anticorruption steps. With regard to corrupt actions detection and punishment of ‘corrupt officials,’ a system of special anticorruption agencies is today nearing completion. Ukraine has established the National Anticorruption Bureau of Ukraine (NABU), the National Agency on Corruption Prevention (NACP) and the Specialized Anticorruption Prosecutor’s Office (SAPO). On March 01, 2018, the draft law on establishing an Anticorruption Court was passed in the first reading. The bill was adopted in full in June 2018.

In the historic dimension, between 2014 and 2018, Ukraine made an unprecedented large number of anticorruption steps. With regard to corrupt actions detection and punishment of ‘corrupt officials,’ a system of special anticorruption agencies is today nearing completion. Ukraine has established the National Anticorruption Bureau of Ukraine (NABU), the National Agency on Corruption Prevention (NACP) and the Specialized Anticorruption Prosecutor’s Office (SAPO). On March 01, 2018, the draft law on establishing an Anticorruption Court was passed in the first reading. The bill was adopted in full in June 2018.

The analysis proved that political will helps taking difficult political and legal decisions and truly change principles and form of the public administration in a manner that will enable it to at least substantially limit rent-seeking activities, if not eliminate corruption altogether.

In general, today we can say that Ukraine is successfully overcoming inherited political corruption in the form of vertically integrated schemes that was the basis of the public administration previously. However, there are still many risks that can turn in the other direction the implemented anticorruption changes.

The slowdown in Ukraine’s reforms is the greatest threat to the country today, as unreformed and corrupted state has no historical perspective. There is a risk that Ukraine might lack “sustainable” political consensus on the content and tools for fighting corruption and, consequently, comprehensive strategic approach to fighting corruption.

Anticorruption prevention mechanisms and enforcement agencies might become dependent on political struggle, as though there might be temptation to transform a real fight against corruption into an instrument of unfair political and economic competition.

The article was based on the report Ukraine’s Fight Against Corruption: the Economic Front Economic Assessment of Anticorruption Measures Implemented 2014-2018. Available [online]: https://goo.gl/4t6MNx

1 “The tax pit (a benefit-forming entity) is a business entity, which is included in the list of tax credit generators of a counterparty and forms a tax benefit to the beneficiary (producer, recipient), including through benefit–transmitters“ (Source: Order of the State Tax Administration of Ukraine No.266 of April 18, 2008, lost effect due to the order of the Ministry of Revenues and Dues of Ukraine No. 165 of June 14, 2013)