Radicalism in France: „it’s not a sin to make money!“. Free movement of people is in danger. Why everyone has to save money just the EU doesn’t? Britain is back in recession. Why to subsidize export of eggs? Overwhelming right-wing criticism of Europe from the communist China.

Let’s start with politics, since euro is a political project. In the last issue, we mentioned Dutch problems with reaching agreement on cuts in public finances which led to fall of the government there. After the collapse of the government, the former Prime Minister saw his package surprisingly getting a majority support in the Parliament and it was possible to approve it finally. Crisis in the whole Europe is cutting off heads of politicians, comethings we definitely noticed also here in Slovakia. The collapse of Dutch government means that slowly there are less and less politicians who were once in the „European core“ together with Germany, determined to do at least some austerity measures. It is another obstacle in the way of quick ratification of the fiscal compact as elections will probably be held no sooner than in three months.

First round of the presidential elections took place in France. Socialist Francois Hollande gained 29% of the votes, current president „rightist“ Nicolas Sarkozy 27% (the quotation marks are justified as the policy of increasing taxes might be considered to be a right-wing policy only in France).

The smart and rich are already preparing for a new fiscal storm. By leaving their home country they support the real estate market in London for example. French celebrities consider taxes at the level of 75% – promised by Hollande – to be slightly too much. French singer and actor Patrick Bruel says that he is happy to pay his fair share to the community, but 75% reminds him more of a confiscation. His indignation at French situation is illustrated by his rather radical statement: „It’s not a sin to make a lot of money. Especially when half of this money is already redistributed today.“

The future french president will be elected in the second round, which will take place on May 6. Polls slightly favor the socialist candidate. This doesn’t mean that independence of ECB won’t be in danger. This never drying out source draws attention of Hollande as well, who in recent interview suggested that ECB should bypass banks in refinancing operations and borrow money directly to states. Unfortunately, the monopoly for production of money is an irresistible temptation for politicians. If Hollande really wins, he will probably re-open negotiations on fiscal compact. In this case its ratification in Slovenia will have to be repeated. Germany consideres postponing the voting until the French election is over.

Also Spaniards keep their fingers crossed for Hollande. They believe that in case of his victory there won’t be that much pressure around them for not fulfilling the deficit goals. Sarkozy would mean the rope around their necks will tighten in the following years.

Regardless of which one will become the president, after the first round it is already clear that nationalism won. Marine Le Pen, the daughter of the controversial politician Jean-Marie Le Pen, the founder of French National Front, surprisingly gained 18% support in the election. For the National Front it is the best result in the history. „The battle of France has only just begun. Nothing will be the same again.“ said 43-year-old politician, who calls for France leaving the eurozone.

The results of forced integration and unfair transfers of wealth are already seen in France. The efforts to integrate Europe through the euro might paradoxically lead to a disintegration in the end. Socialism as a dominant ideology has existed in Europe for a couple of decades already. When we add the nationalist element to socialism, the historical wisdom suggests that it might not end up well.

Bavaria plans to publish the first post World War II edition of Adolf Hitler’s book, Mein Kampf, in German. Germany and France prepared together a proposal to allow reintroduction of border controls inside the Schengen zone as the means of the last resort. These controls could be introduced only temporarily, the discussed length is 30 days. It already started, with temporary closed borders (from April 28 to May 4) between Spain and France to „protect central bankers“ at the ECB summit in Barcelona.

Given the political developments in euro, Tyler Cowen, an economist known mainly from his popular economic blog Marginal Revolution, doesn’t see the future of Europe through pink-glasses either:

“Quite simply, democracy is having its say. The French soon may elect a left-wing candidate who, in essence, wants to exempt France from fiscal rules and place more fiscal risk on Germany. The Dutch can no longer form a governmental consensus on the budget. The Irish will be putting the fiscal compact up for a referendum, and the Greeks are holding an election in May. Even in Germany there could be problems holding together the ruling coalition. In general, voters are unwilling to give up their say over policy, or to regard the European Union or euro zone as necessarily superior to national interests. When it comes to the specifics, it appears increasingly likely that at least one national electorate will pull the plug on the entire set of bailouts and austerity programs.”

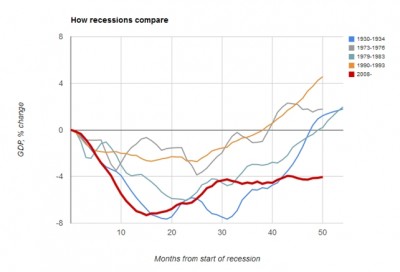

Greek Ministry of Finance site was hacked in protest against the government tapping into citizens‘ bank data in tax evasion fight effort. GDP in Great Britain suffered another slump and the country is officially in recession.

Apart from Britain, also Greece, Italy, Portugal, Ireland and Belgium are also currently in recession. Last Thursday, the rating agency Standard & Poor’s reduced Spain’s rating by two levels from A to BBB+ with negative expectations. Interest rates on the Spanish debt again came closer to the border of 6%.

Slovak rating by S&P is at the level A as well, while Moody’s reduced our rating in February to A2, which is 4 levels off the speculative zone. In Fitch they trust Slovakia bit more and assigned us A.

IMF managed to get a promise from the member states for additional resources reaching $430 billion. Even this won’t be enough. These resources are allegedly for rich countries, now the Fund’s President Christine Lagarde wants to collect further funds for poor Africa. The head economist of IMF Oliver Blanchard calls for Germany to accept the common European bonds and higher inflation as solutions to the crisis. Who is grinning with disbelief at these ideas should know that this gentleman writes economic textbooks and has much more influence on the world than it might seem only from his function in IMF.

ECB published the annual report and Eurostat prepared up-to-date data concerning debts and deficits of the EU’s countries. This data can be found on our webpage. European Commission at the times of radical and unpopular austerity measures in member states calls for increasing the Union’s budget for the next year by 6.8% (here is the EU budget for the year 2011). Indeed, a very sensible approach. There are some speculations that the EU deliberately withholds payments from structural funds to 20 member countries, preparing thus for cuts in regional policy.

We already wrote about eggs here. Many people are surprised that the price is so high not only because the EU regulates the hens breeding, but also because it subsidizes the export of eggs into the world markets out of yours and ours taxes, which makes their price even higher. These subsidies together with subsidies for export of beef were supposed to decrease. Common Agricultural Policy (CAP) of the EU is a source of infinite inefficiency and paradoxes.

Speaking of paradoxes, EU in the times of record high employment comes up with a solution, which will surely increase unemployment according to economists. European Commission calls for introduction of minimum wage in countries where it doesn’t exist (for example in Germany) and increasing minimal wage where it is too low (which may mean anything).

„Europeans are like pandas“ economist Andy Xie writes in communist media of China. „The public sector problems in Italy are similar to China’s with the state-owned enterprises in the 1990s, only several times bigger. Italy’s private sector works better than the public sector but not by much. Numerous activities seem to be subject to government and union restrictions. Supply response is virtually not existent…. Other European economies that are in trouble like Italy’s have similar problems in over-choosing leisure through collective actions like government regulations and union rules… This is why outside help isn’t the solution… Limiting what other people can do seems to be central to the current European thinking on fairness… Because Europeans cannot restrict working hours elsewhere this has caused them frustration. Complaining about working conditions in China, for example, has become a favorite explanation for European economic difficulties. European practices in restricting work treat humans like an endangered species, such as the panda. Indeed, many Europeans seem to behave like pandas, treating privileges as rights. The panda syndrome is the root cause of the European debt crisis.”

Au. This hurt. And from China? So they won’t send any money to save the eurozone?

Have a nice weekend

Juraj Karpiš