About the Greeks beating German-looking pensioners and Greek members of parliament playing black metal, while Merkel is happy to gamble with their lives. About fiscal pact, which is good in one country and bad in another one, about reducing debt with the help of magic and about American budgetary hockey game, which ended 99:0.

After 3 000 years Greeks have improved the art of drama to the level of perfection. After practically nobody happened to agree with anybody they announced new elections for June 17 and caretaker government was set up. Meanwhile bets on Greece leaving the Eurozone increased so much that the British bookmakers had to suspend them. If you still want to bet, try to ask Angela. According to the likely winner of the next Greek elections Alex Tsipras from the leftist-communist formation SYRIZA, Angela Merkel is playing poker with the lives of Greek people. Germans should shut up and pay. To make a point that they are serious, a group of Greek rioters attacked on a Greek beach a German-looking pensioner, and his compelling argument that he was Dutch wasn’t of any help to him.

After 3 000 years Greeks have improved the art of drama to the level of perfection. After practically nobody happened to agree with anybody they announced new elections for June 17 and caretaker government was set up. Meanwhile bets on Greece leaving the Eurozone increased so much that the British bookmakers had to suspend them. If you still want to bet, try to ask Angela. According to the likely winner of the next Greek elections Alex Tsipras from the leftist-communist formation SYRIZA, Angela Merkel is playing poker with the lives of Greek people. Germans should shut up and pay. To make a point that they are serious, a group of Greek rioters attacked on a Greek beach a German-looking pensioner, and his compelling argument that he was Dutch wasn’t of any help to him.

If Merkel is playing poker, she is not very lucky with the cards. Not only did she suffer another loss in local elections, but bluffing the Greeks doesn’t work either. This week she admitted she’d miss Greeks in the Eurozone, therefore she will consider possibility of stimulating their economy with further loans from the taxpayers. She didn’t specify what exactly should the Hellenic economy produce . Also the President of the European Commission Barroso supported the idea that the Southerners should remain in the Eurozone. Who knows if by any chance he isn’t a fan of metal. For example a fresh member of the neo-nazist Golden Dawn Giorgos Germenis is also a bass guitarist of the blackmetal band Naer Maraton (no, this is not an illustrative photo). We’ll see if he will manage to remain in the parliament after the June’s elections.

suffer another loss in local elections, but bluffing the Greeks doesn’t work either. This week she admitted she’d miss Greeks in the Eurozone, therefore she will consider possibility of stimulating their economy with further loans from the taxpayers. She didn’t specify what exactly should the Hellenic economy produce . Also the President of the European Commission Barroso supported the idea that the Southerners should remain in the Eurozone. Who knows if by any chance he isn’t a fan of metal. For example a fresh member of the neo-nazist Golden Dawn Giorgos Germenis is also a bass guitarist of the blackmetal band Naer Maraton (no, this is not an illustrative photo). We’ll see if he will manage to remain in the parliament after the June’s elections.

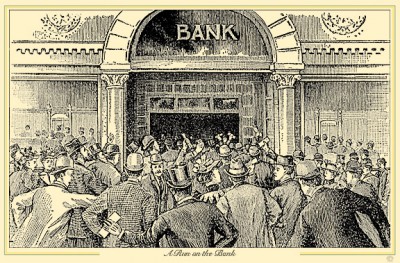

Assurances of the politicians don’t change the fact that wise people have already started constructing scenarios of exit. Portal Zero Hedge published an older (September 2011) analysis of this topic by Willem Buiter. What is likely to happen? In case if Greece stopped fulfilling the conditions of Memorandum and the EU answered with suspending the payments, Greek republic would be forced in few weeks to announce another default. It would write off 90-100% of the renewed debt. Without interest payments, their primary deficit would be 3% of GDP. It means that state would have to defer payment of salaries and  pensions and operation of the public institutions would switch to emergency regime.. Increasing the revenue through taxes reached its limits a long time ago already, so this hole would have to be covered by the government printing their own money. New drachma would lose dozens of percents of value against euro. In case that there will be no dual circulation of the new drachma and euro granted, people will be desperate to get their euros out of the country and banks would have to close their cashpoints. Clients already ran a small test on Monday, when they withdrew from their accounts a record amount of EUR 700 million.

pensions and operation of the public institutions would switch to emergency regime.. Increasing the revenue through taxes reached its limits a long time ago already, so this hole would have to be covered by the government printing their own money. New drachma would lose dozens of percents of value against euro. In case that there will be no dual circulation of the new drachma and euro granted, people will be desperate to get their euros out of the country and banks would have to close their cashpoints. Clients already ran a small test on Monday, when they withdrew from their accounts a record amount of EUR 700 million.

According to JP Morgan Greek exist will cost EUR 400 billion. Fairly enough, but let’s remember that European politicians are ready to pour even more there. It is likely that part of the already overgrown programme within EFSF will continue. Not everyone involved in Greece is losing though. Patience brings benefits and a small group of creditors, who didn’t exchange bonds in March, is happy now. Although they were threatened that they won’t get anything at the end, they earned a total sum of EUR 435 million on May 15, which Greece quietly paid them. Others who suffered 70% loss can just bang their heads against a wall.

Let’s have a bit of rest from Greece. Irish Minister of Finance Michael Noonan once again warned Irish citizens that they should be reasonable and vote YES in referendum concerning fiscal pact. On the contrary, the new French President Hollande said that his country wouldn’t ratify fiscal pact as long as there was no clause about supporting growth – that means about spending money. So money should be saved and spent at the same time. If only someone could get a grasp of this zen truth…

And now a surprise. European politicians can sometimes agree on something. Some time ago British and French fought over the implementation of the new BASEL III rules into the European system. The first ones wanted to have a possibility to define capital adequacy for their huge, but unsound banks, while the others were afraid that it would lead to outflow of the capital from the continent to more stringent, therefore safer British islands. Finally, they reached a compromise. Each country can set its own level of capital adequacy within BASEL, but from some level it has to ask Brussels. London can increase level of capital adequacy of its banks from 7% required by BASEL up to 10% without asking.

Some time ago British and French fought over the implementation of the new BASEL III rules into the European system. The first ones wanted to have a possibility to define capital adequacy for their huge, but unsound banks, while the others were afraid that it would lead to outflow of the capital from the continent to more stringent, therefore safer British islands. Finally, they reached a compromise. Each country can set its own level of capital adequacy within BASEL, but from some level it has to ask Brussels. London can increase level of capital adequacy of its banks from 7% required by BASEL up to 10% without asking.

Debt and deficit can be reduced not only by cutting spending, but also with magic, specifically accounting magic. The Chief economist of OECD Pier Carlo Padoan suggested that public investments labeled „growth supporting“ shouldn’t be included in deficit. Similar strategy was already tried by Greece 10 years ago. We all know how it ended.

Hungary managed to juggle part of its debt even without accountancy magic. Forint strengthened in the first quarter of 2012 by 7%, thanks to which Hungarian debt decreased from 80.6% to 78.9% of GDP.

International creditors are going to visit Portugal and control how their money is thriving in the light of potential Greek exit.

There is clearly still enough money in the EU. Otherwise it is difficult to explain why the Commission decided to exclude non-European suppliers from the public contracts of EUR 5 million value. The Commission reasons the EU is also discriminated in the countries outside Europe. The question is why it should concern taxpayers who will pay higher price for hurt European pride. Strategy of mutual blocking of international trade didn’t work out at the time of the Great Depression, there is no reason to try it again.

The European theater stage reminds an Argentinian soap opera while life in the rest of the world remains outside our interest. It’s a pity because there are interesting things happening also in other parts of the world. For example Barack Obama lost in Senate 0:99 voting on the budget. Two months ago it was 0:414 in the Congress. It seems that all the players shoot just on one goalie. US has had provisional budget for three years, but that isn’t any obstacle to spending. So the goalie won’t change.

Have a nice weekend with lot of interesting matches

Martin Vlachynský