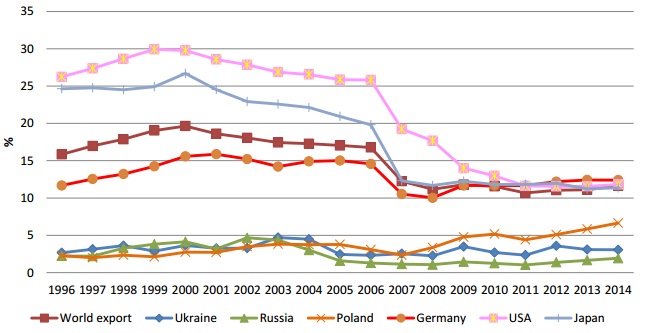

Customs in Ukraine: Business Wants Reforms, Government Seeks to Maximize Revenue

BY

Iryna Fedets AND The Institute for Economic Research and Policy Consulting - Kyiv / March 15, 2016

Businesses in Ukraine want the customs procedures to become less income-focused and instead, to be aimed at facilitating trade. As the 2015 survey of Ukrainian businesses by the Institute for Economic Research and Policy Consulting showed, changes in trade regulations and customs rules are needed to boost international trade.