Central banks still don’t provide monetary opium, how long will the current illusions last without it? New taxes and economic growth. Milton Friedman would be 100 years old. Crisis is 5 years old.

Last week we challenged the governor of the ECB Mario Draghi, who promised the moon to the markets, to stop talking and to show the money instead (Show Me the Money!). This week it turned out that there is no money to cover his promises. He bluffed.

Do you remember those times before Christmas when parents told you that you will find valuable gift under the Christmas tree, and then instead of a new bike you found a slide rule? This is how some of the share holders must have felt during last week’s press conference of ECB after Governing Council’s meeting concerning further steps in monetary policy.

ECB didn’t reduce interest rates, didn’t announce new LTRO, didn’t reduce interest rates on the commercial banks‘ deposits in ECB and it didn’t guarantee purchase of the state bonds in the close future either. It ordered its committee to prepare in the next couple of weeks a plan concerning if and when to start purchasing state bonds. Draghi provided the markets with unexpected cold shower by specifying the conditions for the launch of these purchases. ECB may start buying short-term state bonds, when all of the following conditions are fulfilled: 1. Given state officially asks for help from EFSF or ESM and accepts conditions connected with receiving it 2. EFSF and ESM provide, within their capacity, aid to this country 3. These purchases will fall into (not specified in more details) „aims of the monetary policy“. If ECB really acts according to these rules, it can mean tightening the monetary policy, as last year ECB purchased Italian bonds without fulfilling at least two of the conditions mentioned above. On the other hand, Draghi mentioned in his speech the fragmentation of the financial markets in the Eurozone, which probably signals some form of a future quantitative easing by ECB. At the same time he promised to get rid of the preferred creditor status of the ECB and ESM, which discourages private investors from purchasing problematic bonds.

It’s not exactly what market players were waiting for after the strong words of the senior officials escalating in the media last weeks. The reaction was immediate. Euro has dropped even before Draghi finished his speech and gave the floor to the journalists. Risky assets levitating on the empty promises dropped like a rock. Spanish bonds market closed with the loss of -5.5%, Italian one with -4.6%. Spanish ten-years bonds are now safely back at 7% (7.3% drop on Thursday was the biggest noted daily drop of these bonds), Italian ones came within a few hours from 6% to 6.3%.

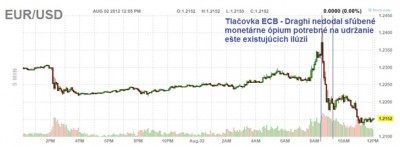

Disappointment is clearly seen in the chart showing exchange rate of euro against American dollar. It is funny that while Draghi was talking about euro that it is „irreversible“ and that „it is unreasonable to sell euro, because euro will stay here,“ it dropped by 2%! Even after his predecessor Trichet left, it is still true that if you do exactly the opposite of what central banks tell you, you will earn a lot of money.

Revealing Draghi’s bluff once again shows damaging influence of central planners in the state monopoly money producers on the process of shaping price on the markets. How can one man (even if he was vice-president of Goldman Sachs) in a few minutes change this way the prices on such a gigantic market operating with a trillion of dollars a day? How many relative prices were influenced by by empty verbal promises? What other expectations and investment projects are based on the mistaken interpretation of speeches, gestures, possibilities and capabilities of the modern prophets and will have to be liquidated at high economic costs? In true capitalism nobody should have such a power to easily play with assets and money of hundreds millions of people. And for sure not a monopoly with politically nominated leaders. This is why central banks should be abolished.

Milton Friedman would celebrate his 100th birthday last week. In 1986, after rich experience with functioning of the central banks and their ability to comply with any rules, he wrote: “Our own conclusion … is that leaving monetary and banking arrangements to the market would have produced a more satisfactory outcome than was actually achieved through government involvement.“

Representatives of FED, who had meeting before ECB, didn’t promise newly printed money either. Worsening economic indicators are probably not bad enough to make the governor Ben Bernanke release hundreds of billions of fresh dollars into the market in the sensitive pre-election times. QE3 has not been activated yet, Ben promised that it will be when it is necessary, which can mean anything.

France introduced from August 1 tax of 0.2% on financial transactions involving French shares (which are on a list of 109 companies). Probably there is no need to explain how this will affect refinancing of the affected French companies on the capital markets. President of the Austrian commercial bank Erste Group Andreas Treichl warns Czech Republic against joining the Eurozone. „If the current tendency continues, do not join the Eurozone“. „Czech Republic is in a good situation. It has its own currency and monetary policy. If Czech Republic continues in the established course, in three-four years it will be one of the best place for investments,“ said Treichl, who doesn’t see closer cooperation of the monetary union’s member states as a solution, on the contrary.

You know who will also celebrate birthday? The crisis. It is 5 years old already! On August 9, 2007, European Central Bank in the view of worsening situation on the financial market released into circulation unprecedented amount of new euros – it borrowed 94.8 billion at the interest rate of 4% to the banks. Times have changed and today 100 billion is not enough to save Spanish banks, not to mention the Eurozone.

If you are going to a birthday party, you definitely should get a costume at our public-law cultural and institution – Matica slovenska. You can be dressed as a bird or as a pig for example.

We can say that your taxes are already paid the renting fee (subsidies for supporting cultural activities of Matica slovenska in the year 2011 reached EUR 1.5 million).

Cute animals? That means that the week is ending.

Have a nice weekend!

Juraj Karpiš